Orbex Market Insights – August 28

Aug 28, 2017

Jeremy Parkinson

Finance

In this week’s market update, we take a look at the most important event that moved the markets at the end of last week. Jackson Hole meetings finally moved the markets after a boring few days, led by some central bankers’ remarks, including the Chair Yellen and Mario Draghi, who both took a different approach. […]

Futures Flat As Gasoline Soars On Harvey Devastation, Rising Euro Sends European Stocks Lower

Aug 28, 2017

Jeremy Parkinson

Finance

With billions in economic losses and unknown supply chain shocks to come following devastating and historic flooding in Texas, S&P futures are virtually unchanged (down less than 0.1% at time of writing) while European and Asian shares are modestly lower as oil was little changed. As reported yesterday, gasoline futures surged as the greater impact […]

Euro Granted More Breathing Room For Gains, For Now

Aug 28, 2017

Jeremy Parkinson

Finance

Fundamental Forecast for EUR/USD: Neutral – ECB President Draghi’s speech at Jackson Hole didn’t explicitly do anything to promote a stronger Euro, but it certainly do anything to dissuade it either. – Upcoming August Euro-Zone CPI data will show that price pressures have stabilized, after turning lower through the second quarter. – Net-short EUR/USD positions have surged among retail […]

Forex Week In Review – Monday, August 28

Aug 28, 2017

Jeremy Parkinson

Finance

Last week was another mixed affair for the world’s major markets with US markets and the FTSE making gains. Friday marked the final trading session for August for the purposes of these reports and only the gold price showed a gain over the month. In Europe over the course of the week, the FTSE was […]

Monday’s Dollar Blues

Aug 28, 2017

Jeremy Parkinson

Finance

The US dollar’s pre-weekend losses were extended initially in Asia before it recovered sufficiently to give European participant a better selling level. The dollar selling into the shallow bounce reflects the bearish sentiment, which as we see it, was simply fanned by both Yellen and Draghi did not alter the status quo in their Jackson […]

EUR/USD: Monday Expecting The Formation Of A Correctional Model

Aug 28, 2017

Jeremy Parkinson

Finance

Previous: On Friday August 25th, trading on the euro/dollar currency pair closed 1.02% up. Before Janet Yellen’s speech in Jackson Hole, the euro was trading around the LB balance line within a range of 1.1773 to 1.1828. At the Federal Reserve’s annual conference, Yellen talked about financial stability and banking regulations. She gave no mention […]

Damned Data – Full Week Preview

Aug 28, 2017

Jeremy Parkinson

Finance

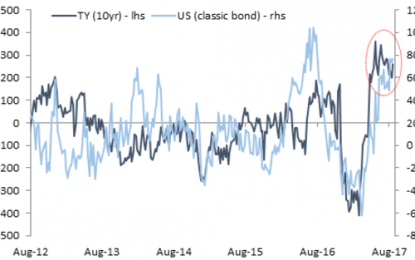

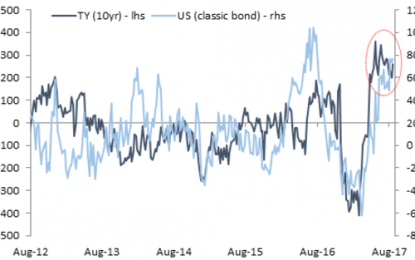

The overarching narrative for this week shouldn’t be materially different from last week – people will be concerned about the same things, namely the looming debt ceiling debate, the odds of a government shutdown which ebb and flow with whatever shows up on Trump’s Twitter feed, and the fallout from North Korea’s latest ballistic missile […]

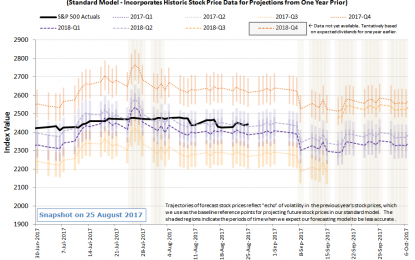

Aligned Expectations For The S&P 500 In Week 4 Of August 2017

Aug 28, 2017

Jeremy Parkinson

Finance

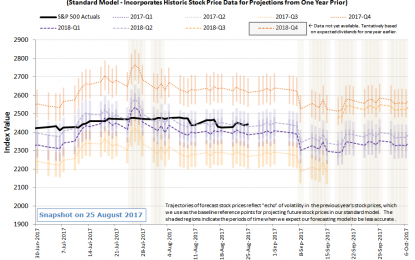

The fourth week of August provided an almost textbook example of how stock prices behave when investor expectations are closely aligned with the signals being sent by the economy’s major players. Specifically, we’re referring to what appears to be a very strong focus by investors on the distant future quarter of 2018-Q2 in setting the […]

Above The 40 – No Follow-Through For The S&P 500’s Reflex Bounce

Aug 28, 2017

Jeremy Parkinson

Finance

AT40 = 38.6% of stocks are trading above their respective 40-day moving averages (DMAs)AT200 = 48.0% of stocks are trading above their respective 200DMAsVIX = 11.3Short-term Trading Call: neutral Commentary The S&P 500 (SPY) is suddenly struggling at its 50-day moving average (DMA). The big reflex bounce from Tuesday, August 22nd has yet to receive confirmation. On Friday, the index […]

FX Week Ahead: US GDP And Payrolls, Eurozone Inflation

Aug 28, 2017

Jeremy Parkinson

Finance

The slow pace of the markets is likely to come to an end as traders prepare for a busy September. The week ahead will start off on a somewhat slow note but picks up the pace by mid-week. Economic data includes key market moving events such as the US GDP numbers and the flash […]