Risks For This Asset Class Are Asymmetrically Skewed To The Downside

Aug 27, 2017

Jeremy Parkinson

Finance

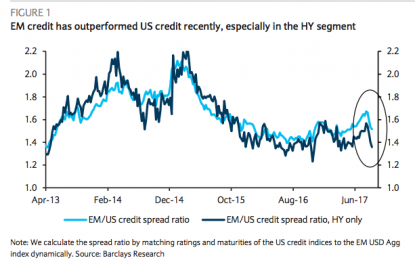

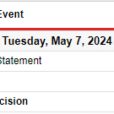

Just a quick note on emerging markets. We’ve talked a lot lately about the extent to which EM credit weathered the storm a bit better than HY this month as Trump turmoil and heightened risk on the Korean peninsula catalyzed a bout of risk-off sentiment – or, perhaps more appropriately, “what counts as risk-off sentiment these days.” […]

The Best Trump Trade Wasn’t Made In America

Aug 27, 2017

Jeremy Parkinson

Finance

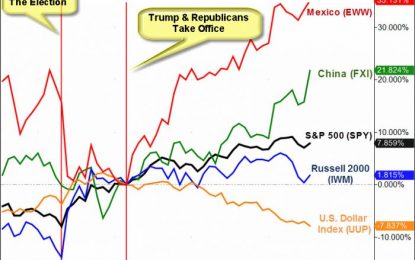

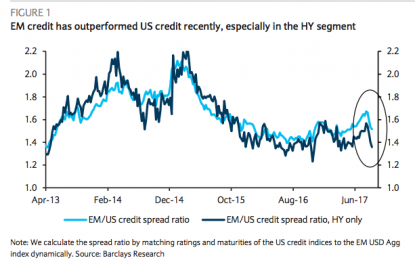

Sometime a picture says it all. This week’s Market Outlook commentary is simply the observation you choose to find in this chart. All politics aside (although they are likely the driving force behind these trends). The chart illustrates the percent change trends of key markets since President Trump’s inauguration.In an effort to avoid misrepresenting the […]

E

Shorting Volatility Affords Multiple Opportunities

Aug 27, 2017

Jeremy Parkinson

Finance

The last few weeks have been quite turbulent for volatility traders with swings in the VIX of greater than 20% on several occasions. The roller-coaster ride in volatility indicated in the chart below identifies, however, real opportunity and not just implied opportunity. Timing volatility from the long side would prove to be difficult, but adding […]

EUR/USD Bullish, Resumes Its Medium Term Uptrend

Aug 27, 2017

Jeremy Parkinson

Finance

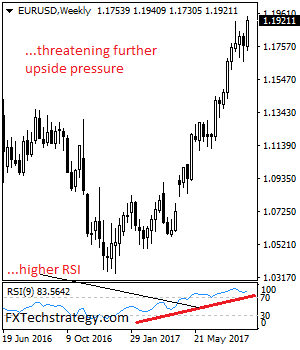

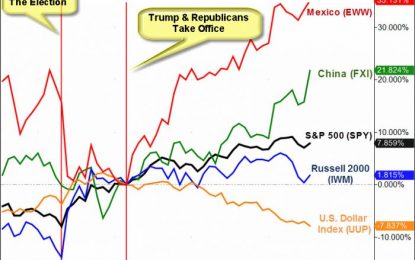

EUR/USD: The pair remains biased to the upside after resuming its medium term uptrend the past week. Resistance comes in at the 1.1950 level with a cut through here opening the door for more upside towards the 1.2000 level. Further up, resistance lies at the 1.2050 level where a break will expose the 1.2100 level. […]

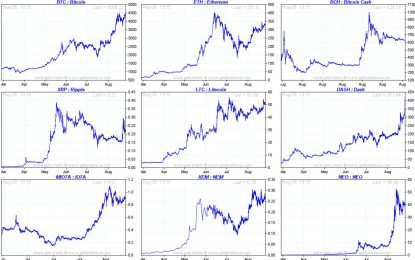

The Top 9 Cryptocurrencies Of 2017 In One Chart

Aug 27, 2017

Jeremy Parkinson

Finance

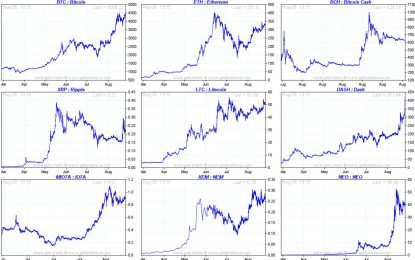

The top 9 cryptocurrencies of 2017, in terms of market cap, are visualized in this one chart. It is a 6-month chart, and it includes the start of the big rise of alt-coins in March of this year. It is amazing to see how strong most of these cryptocurrencies have risen. Interestingly, there is a diverse picture […]

Do Women-Led Companies Outperform?

Aug 27, 2017

Jeremy Parkinson

Finance

Is There Alpha In Gender Disparities? The conventional wisdom for years, as this Harvard Business Review post exemplifies, has been that having more women as senior executives and directors would improve corporate performance. It appears that this may be untrue. I elaborate below, and discuss whether awareness of this may be a potential source of […]

Forex Forecast: Pairs In Focus – Sunday, August 27

Aug 27, 2017

Jeremy Parkinson

Finance

The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to […]

All Things Bullish

Aug 27, 2017

Jeremy Parkinson

Finance

“Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria.” – Sir John Templeton Dogs bark, birds sing, stock markets (and stocks themselves) fluctuate. Bonds, commodities, currencies, and all else that moves in the economic world will fluctuate. Only the economic market, however, transforms into a new beast when […]

Gold Wars

Aug 27, 2017

Jeremy Parkinson

Finance

Gold is not the main focus of this blog although it is an important signal we monitor that can indicate that something important may be happening the in the monetary system. Gold has been in and out of the official monetary system for a long time so people do view it more like money than […]

Fed Models Facing Technological Disruption

Aug 27, 2017

Jeremy Parkinson

Finance

By Financial Sense Technology is having a massive disinflationary impact on the global economy and, when it comes to interest rates and monetary policy, we need to rewrite the playbook to a certain degree, noted a strategist from BlackRock in a recent interview with FS Insider. skeeze / Pixabay Consider Blackrock Outlook: Technology Causing Historic Supply-Side Shock […]