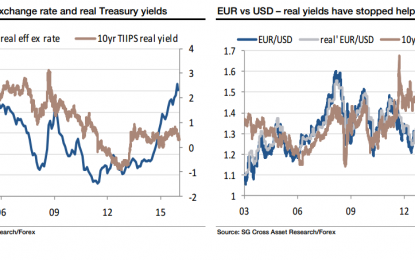

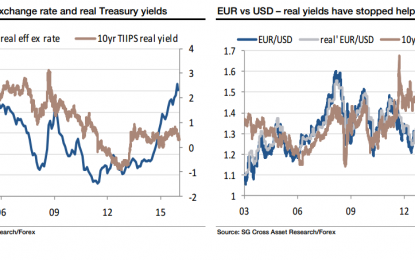

Is The USD Rally Over For Good Or Over For Now? – SocGen

Mar 18, 2016

Jeremy Parkinson

Finance

The Fed took the extreme dovish path, hitting the dollar hard. Is this is an even more significant change? The team at SocGen weighs in: Here is their view, courtesy of eFXnews: The term ‘Currency Wars’ was used by Brazil’s erstwhile Finance Minister, Guido Mantega, in September 2010 in response to moves by some (Asian) countries […]

A Bear Market Rally?

Mar 18, 2016

Jeremy Parkinson

Finance

Mixed markets often lead to a debate over the primary trend. Bearish pundits insist: This is just a bear market rally.It can be sharp and strong, but overall conditions are still bearish. Bullish pundits suggest the opposite: There is a strong bullish trend.Some dips occur, but these are merely buying opportunities. Both traders and investors […]

Binary Options Trading Opportunities – March 18, 2016

Mar 17, 2016

Jeremy Parkinson

Finance

During the day on Friday, we had several announcements but nothing that is a huge concern. Because of this, we believe that the market will be very technically driven. Silver looking to break out Silver markets had a very strong session during the day on Thursday, cracking above the $15.80 level. Because of this, we […]

Bulls: Nothing Can Stop Us

Mar 17, 2016

Jeremy Parkinson

Finance

To my thinking once again, the best bulls can do is take us back to the ugly and unproductive trading range of 2015 & early 2016. Savant, I am not. I adhere to the philosophy of economist Edgar Fielder who stated: “If you must forecast, forecast often”. There is no economic data or earnings to […]

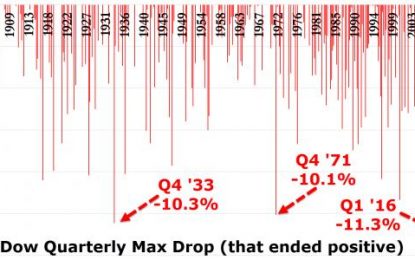

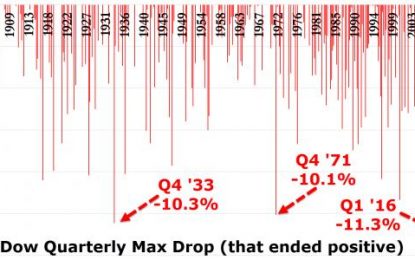

Fed ‘Downgrade’ Sends Stocks To Largest Quarterly Comeback…Ever

Mar 17, 2016

Jeremy Parkinson

Finance

It’s easy… But, before we start, some context for just how different it is this time… if The Dow is able to hold this gain through the end of the quarter, it will be the largest quarterly comeback in the history of stocks… And all it took was the four largest central banks in the world […]

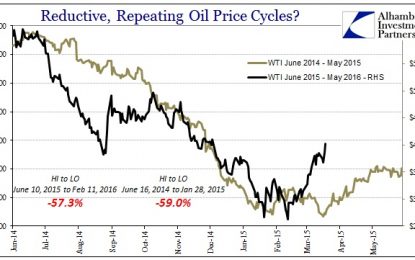

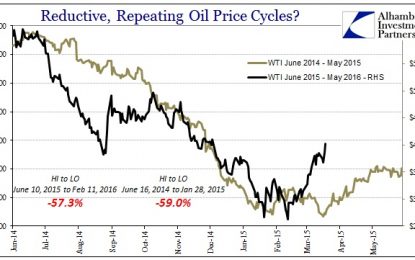

Does It Matter If Oil Prices Have Already Traded In The Same Pattern Just One Year Offset?

Mar 17, 2016

Jeremy Parkinson

Finance

From June 2014 until late January 2015, oil prices (WTI) fell about 60%. From June 2015 until late January 2016, oil prices (WTI) fell about 60%. The exact track each annual trading history took to achieve those results is different (2014-15 much more straight ahead and persistent; 2015-16 jagged and irregular), but you can’t deny […]

Dangling From The Tree

Mar 17, 2016

Jeremy Parkinson

Finance

I’m going to do a longer post later, but I wanted to mention Apple. On a day in which markets vomited up to the highest levels of the entire year, Apple (AAPL) actually managed to lose some value. I think this is quite telling since, as I’ve said repeatedly here in the hallowed hallways of Slope, Apple […]

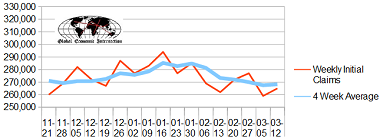

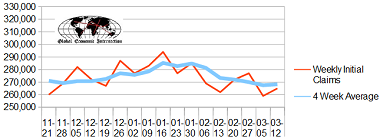

Initial Unemployment Claims Rolling Average Insignificantly Worsens. Longest Streak Of Claims Under 300,000 Since 1973

Mar 17, 2016

Jeremy Parkinson

Finance

Weekly Initial Unemployment Claims The market expectations (from Bloomberg) were 265,000 to 279,000 (consensus 270,000), and the Department of Labor reported 265,000 new claims. The more important (because of the volatility in the weekly reported claims and seasonality errors in adjusting the data) 4 week moving average moved from 267,250 (reported last week as 267,500) […]

Valeant Hit My $35 Price Target; Now What?

Mar 17, 2016

Jeremy Parkinson

Finance

Tuesday the Valeant VRX released preliminary unaudited Q4 financial results and it did not go well. I perused the results, saw that the 2016 revenue forecast was shy of previous estimates and assumed the stock would rise 10% as usual. By mid-morning my brokerage account had gone haywire; VRX had free fallen 45% and my […]