Fed Holds Rate Steady, Asia Markets Jump

Mar 17, 2016

Jeremy Parkinson

Finance

The Federal Reserve held interest rates steady on Wednesday and indicated that moderate U.S. economic growth and strong job gains would offer opportunities for it to tighten policy this year. The U.S. central bank, however, pointed to ongoing risks from an uncertain global economy which could lead to rate hikes sooner than anticipated. The Fed […]

How To Make Your Retirement As Profitable As Possible

Mar 17, 2016

Jeremy Parkinson

Finance

James Altucher thinks 401k retirement plans are scams. In a video that went viral after being posted last year on Business Insider, the 48-year old hedge fund manager, entrepreneur and best-selling author says that “I honestly think that you should just take your money out of 401ks.” His reasons? He lists three. You’ll have no […]

USDU Update… An Important Chart

Mar 17, 2016

Jeremy Parkinson

Finance

Last week I showed you this potential H&S top forming on the USDU which is a more evenly balanced index for the US dollar which actually trades as an ETF. I built this chart using a line chart and then leaving the trendlines in place I converted to a bar chart. As you can see […]

The FTSE 100 Rises On A Dovish Fed

Mar 17, 2016

Jeremy Parkinson

Finance

The FTSE 100 (FXCM: UK100) is slightly higher today in line with European indexes. The motivation for the latest rise is yesterday’s dovish message by the Fed. A key change was the reduction of the Fed implied rate by the end of the year, now signaling two rate hikes from four in December. This has […]

Bring On The Clowns

Mar 17, 2016

Jeremy Parkinson

Finance

If we are not seeing a case of deliberate attempts to break the back of their own currencies among these Central Bankers, then “Scotty, beam me up!” With the Fed Fund futures showing sharp increases AHEAD of the FOMC statement of rate hike probabilities, yesterday’s ultra dovish statement had everyone positioned on the wrong side […]

World’s Second Largest Reinsurer Buys Gold, Hoards Cash To Counter Negative Interest Rates

Mar 17, 2016

Jeremy Parkinson

Finance

The world’s second-largest reinsurer, German Munich Re which is roughly twice the size of Berkshire Hathaway Re, is boosting its gold reserves and buying gold in the face of the punishing negative interest rates from the European Central Bank. As caught by Mark O’Byrne at GoldCore and reported by Thomson Reuters this afternoon, the world’s largest reinsurer is far from […]

38% Of Companies To Reduce Employment In 2016, Only 29% Expect Increase: Five Consequences

Mar 17, 2016

Jeremy Parkinson

Finance

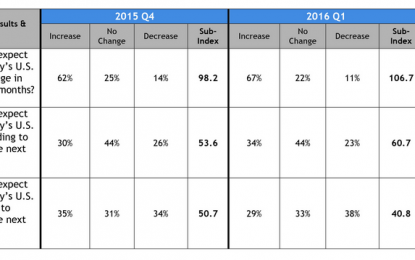

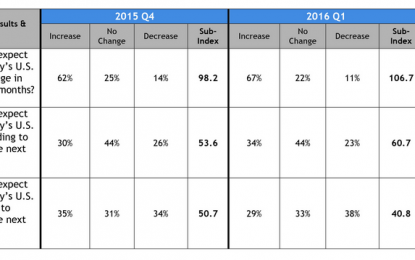

Is the part-time hiring binge that has inflated job numbers for at least two years about to come to an end? I think so. More importantly, so do CEOs of large corporations. In December, a quarterly survey of large corporation CEOs showed a minuscule net of 1% (35% to 34%)of corporations expected an increase in […]

The Origins Of Both Endogenous Money And The Industrial Revolution

Mar 17, 2016

Jeremy Parkinson

Finance

Written by Philip Pilkington The latest issue of the Review of Keynesian Economics (ROKE) is out and it looks like this publication is taking off fast. It includes, among other things, an introduction by the president of the Argentinian central bank (which is available free online) and a book review by me (which is not). […]

Today’s Trade: The Market’s Fight Song

Mar 17, 2016

Jeremy Parkinson

Finance

Technical Outlook: Extremely dovish and extremely unexpected FOMC Statement yesterday that cut the yearly outlook of 4 additional rate hikes down to 2 additional rate hikes. As a result, Yellen, by cutting the number of rates for the year, essentially gave the market the equivalent of two rate cuts yesterday. Be careful today, because a […]

S&P 500 And Nasdaq 100 Forecast – March 17, 2016

Mar 17, 2016

Jeremy Parkinson

Finance

S&P 500 The S&P 500 initially fell during the day on Wednesday, but with the Federal Reserve suggesting that there are going to be less interest-rate hikes than originally anticipated, the markets got moving yet again. The market looks as if it is ready to go higher but there’s a lot of noise between here […]