How Chinese Traders Spend Golden Week: History And Habits

Feb 05, 2016

Jeremy Parkinson

Finance

The Golden Week refers to the 7-day national holiday celebrated in mainland China and some of its territories. This was officially implemented by the Chinese government in 2000 as a way to boost local tourism and allow people to visit their family in other parts of the country. It starts off during the National […]

So, Bill Ackman Makes Some Good Points On The Index Bubble…

Feb 05, 2016

Jeremy Parkinson

Finance

He’s often controversial… and usually pretty brash. But Pershing Square’s Bill Ackman is also usually quite insightful. He’s been at this game a long time, and he’s had his share of big wins… and big losses. Ackman has an ego on him. (What hedge fund manager doesn’t?) But he’s also his own biggest critics, and like all good […]

Transportation Sector Woes Continue

Feb 05, 2016

Jeremy Parkinson

Finance

Not Getting Better In late July last year, not long before the stock market delivered a major “warning shot” with its sharp decline in August, we wrote about the transportation sector in Transportation Sector in Trouble – What are the Implications? As we noted at the time, the sector seemed to send a potential “economic red alert”. […]

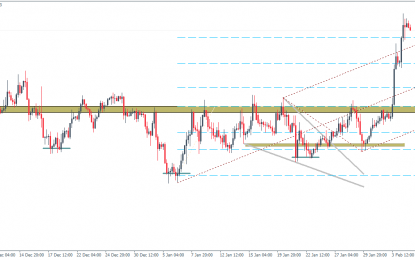

Gold Remains Bullish Above 1145 – 1140

Feb 05, 2016

Jeremy Parkinson

Finance

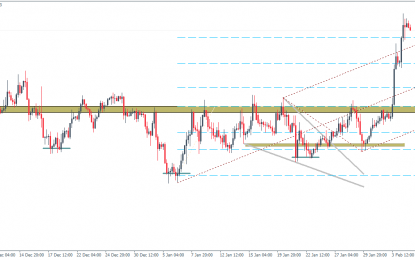

Daily Forex Market Preview, 05/02/2016 The markets were unrelenting yesterday as EUR/USD posted new monthly highs including Gold while USD/JPY continued to fall back to below the 117 handle. The January payrolls report from the US is due today which is likely to be key to either further weaken or help the US Dollar recoup […]

Daily Market Analysis Video – February 5, 2016

Feb 05, 2016

Jeremy Parkinson

Finance

On Friday, we get the all-important jobs number out of the United States, and that of course will have the market focusing on the United States, however, don’t forget that this tends to move the markets in general, so more than likely we will get a knock on effect everywhere. 1 – At this point […]

Market Talk – February 4, 2016

Feb 05, 2016

Jeremy Parkinson

Finance

Japan was again the talking point of the session with yet another down day. Initially, the index opened up 0.5% but it was just a matter of time until the sell orders hit the screens again and we were all looking for the bid. The stronger Yen was one reason being provided and we did […]

E

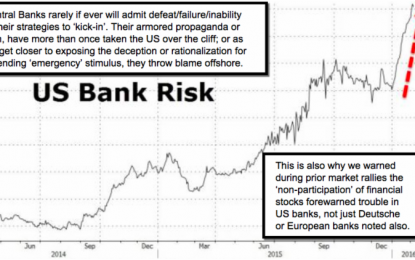

Pundits ‘Hunting’ For ‘Signs Of A Bear’

Feb 05, 2016

Jeremy Parkinson

Finance

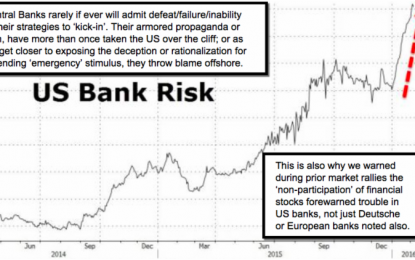

Pundits ‘hunting’ for ‘Signs of a Bear’ are almost in a frenzy debating how many days a bearish trend lasts over, and whether it’s absent or in-anticipation of, a ‘recession’ starting. Of course history is quite replete with examples and a slew of variations; so the exercise in mapping-out expectations seems futile. That’s so, in […]

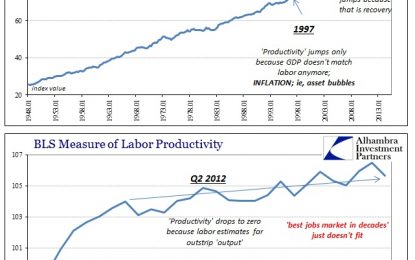

Robust Job Growth Doesn’t Make Sense And The Numbers Show Why

Feb 05, 2016

Jeremy Parkinson

Finance

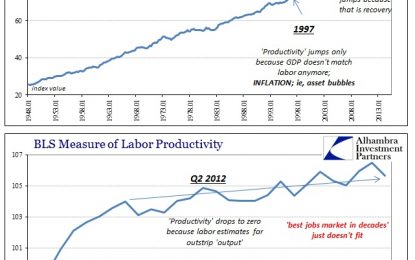

With the BLS’s release of Q4 productivity figures, we get to check the BLS’s estimates just in time for tomorrow’s increasingly irrelevant payroll report. That much has become thoroughly apparent especially since the middle of last year as the Establishment Survey and unemployment rate only diverge with the overall breadth of economic indications. With GDP no longer corroborative, […]

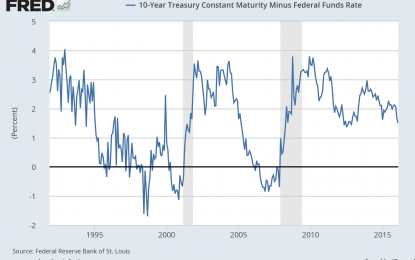

A 2016 Recession Would Be Different

Feb 04, 2016

Jeremy Parkinson

Finance

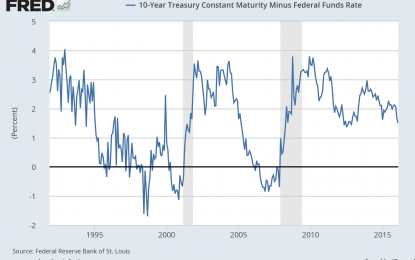

If the US or the Eurozone entered a recession this year, a few macroeconomic variables would look very different relative to previous recessions. 1. The Yield curve would be very steep. Unlike in any previous recession when the yield curve was flat or inverted. 2. The real federal funds rate (or the ECB real repo […]

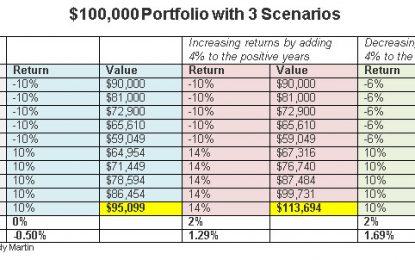

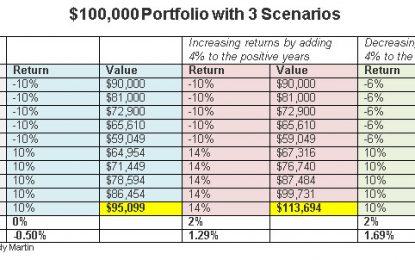

Not Preventing Market Losses? You Better Start Now

Feb 04, 2016

Jeremy Parkinson

Finance

What’s more important? Making gains in the stock market or preventing losses? Before answering that question, let’s list a few common fallacies about risk: The full spectrum of market risk can be accurately defined in a single magic formula or statistic Long-term investing always guarantees success, so go ahead and take all the risk you’d […]