Why Getting Valuation Right Is So Important To Retired Dividend Growth Investors

Dec 09, 2015

Jeremy Parkinson

Finance

Introduction Although getting valuation right before you buy a stock is critically important to the long-term oriented retired dividend growth investor, it is not a short-term market timing concept. My point is that short-term market movements are typically volatile and unpredictable. The reason is simple. Over short periods of time, which I define as less […]

EU Session Bullet Report – Oil Slumps As Demand Cools, USD Leading The Way

Dec 09, 2015

Jeremy Parkinson

Finance

Oil recovered slightly yesterday and is currently trading above $38 per barrel although the black gold remains under pressure. Soft trade numbers from China on Tuesday highlighted the struggle facing the worlds’s 2nd largest economy, only serving to confirm concerns over cooling demand. Asian stocks were trading slightly lower this Wednesday morning reflecting current sentiment […]

When Does The Demographically-Related Pension Ponzi Scheme Blow Up?

Dec 09, 2015

Jeremy Parkinson

Finance

Reader “GM”, an actuary student in Malaysia pinged me with an accurate observation on demographics, but missed the boat on a solution. GM writes …. I thought I would point out the reason for this monetary madness, which I believe you had brought up before. Aging populations consume less, and have different consumption patterns to […]

EC

Negative Interest Rates Are Due To Bad Theory

Dec 09, 2015

Jeremy Parkinson

Finance

If something very strange happens and continues over an extended period, people get accustomed to it and come to view it as normal. That’s especially so when the strange set of circumstances is the result of a policy that, as a result of devotion to a wrong theory or strategy, is widely considered to be […]

![Euro/Dollar: Technical Picture Contradictory]()

Euro/Dollar: Technical Picture Contradictory

Dec 09, 2015

Jeremy Parkinson

Finance

Yesterday’s Trading: By the end of Tuesday, the euro was up against the dollar by 60 points to 1.0891. The Swiss franc was also stronger against the USD. The Aussie and the pound were down. The market is undergoing a correctional phase after the ECB meeting and Draghi’s words. Main news of the day (EET): […]

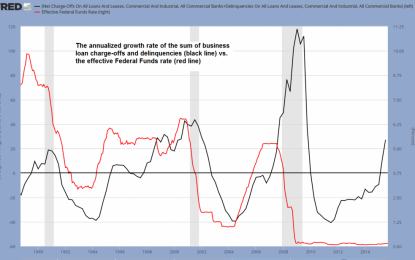

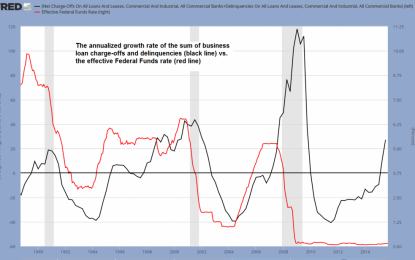

Corporate Loan Charge-Offs And Delinquencies Surge

Dec 09, 2015

Jeremy Parkinson

Finance

Another Bump Higher In one of our recent updates on the weakness in the manufacturing sector we have mentioned the surge in the sum of charge-offs and delinquencies of commercial and industrial loans at US banks (hat tip to our friend BC, who inspired the chart below). As we were arguing at the time, this […]

The Latest Look At Long-Term Trends In Employment By Age Group

Dec 09, 2015

Jeremy Parkinson

Finance

The Labor Force Participation Rate (LFPR) is a simple computation: You take the Civilian Labor Force (people age 16 and over employed or seeking employment) and divide it by the Civilian Noninstitutional Population (those 16 and over not in the military and or committed to an institution). The result is the participation rate expressed as […]

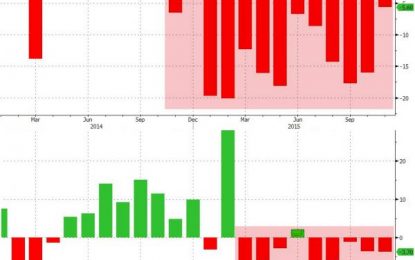

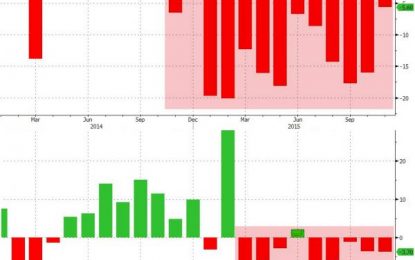

Behold The Deflationary Wave: How China Is Flooding The World With Its Unwanted Commodities

Dec 09, 2015

Jeremy Parkinson

Finance

Between commodity-backed financing deals and the centrally-planned mal-investment boom-driven excess capacity, China has a lot of ‘liquidation’ to do to normalize from a credit-fueled smoke-and-mirrors world to a painful reality. As Bloomberg notes, there’s no let-up in the onslaught of commodities from China. While the country’s total exports are slowing in dollar terms (as we noted last night), shipments […]

What Assets Should You Have In Your Moderate Portfolio?

Dec 09, 2015

Jeremy Parkinson

Finance

Ibbotson Associates provides asset allocation guidelines that span the risk spectrum from conservative to aggressive. The moderate portfolio consists of roughly 42% in U.S. Stock, 18% in Non-U.S. Stock, 35% Fixed Income and 5% in Cash. It follows that the static Ibbotson model might employ the following ETFs to achieve its moderate growth and income […]

Guess What Happened The Last Time Junk Bonds Started Crashing Like This? Hint: Think 2008

Dec 09, 2015

Jeremy Parkinson

Finance

The extreme carnage that we are witnessing in the junk bond market right now is one of the clearest signals yet that a major U.S. stock market crash is imminent. For those that are not familiar with “junk bonds”, please don’t get put off by the name. They aren’t really “junk”. They simply have a […]