Wage Inflation And Fed Comments On An Inverted Yield Curve

Sep 07, 2018

Jeremy Parkinson

Finance, No picture

(Audio length 00:13:22) Chris Temple joins me today to recap the job data and the most important aspect of this month’s data, wage inflation. With wage inflation finally starting to tick up there are new factors at play for investors. We also discuss recent comments made by NY Fed President John Williams regarding the Fed’s […]

Trump Eyes Another $267 Billion In Tariffs (And He’s Foolish Enough To Do It)

Sep 07, 2018

Jeremy Parkinson

Finance, No picture

As Trump ponders $200 billion in tariff threats, he eyes another $267 billion on top of that. Please consider Trump says has tariffs ready for further $267 billion worth of Chinese imports. U.S. President Donald Trump said on Friday that he has tariffs ready to go on a further $267 billion worth of Chinese imports, as […]

S&P 500 ETFs – Friday, Sept. 7

Sep 07, 2018

Jeremy Parkinson

Finance, No picture

The S&P 500 index is arguably the most well-known worldwide. It is based on the market cap of the 500 largest companies in the U.S. The first-ever ETF, introduced in 1989, hoped to mimic the index, but was short-lived due to a lawsuit. Several S&P 500 ETFs have been brought to market since, and we […]

GBP/USD Poised For Big Breakout

Sep 07, 2018

Jeremy Parkinson

Finance, No picture

(Video length 00:03:41)

Record Gold/Silver Shorts!

Sep 07, 2018

Jeremy Parkinson

Finance, No picture

Gold and silver were thrashed this past summer, relentlessly pounded to deep new lows. That has fueled extreme bearishness, with traders convinced the precious metals’ fundamentals are rotten. But epic all-time-record futures short selling by speculators was the real culprit. These unprecedented shorts must soon be covered with proportional buying, which is super-bullish for gold […]

DXY Index Working On Bullish Outside Engulfing Bar After NFP

Sep 07, 2018

Jeremy Parkinson

Finance, No picture

Talking Points: The August US Nonfarm Payrolls report was all-around solid, helping pave the path to a positive close for the DXY Index in the first week of September. However, concerns loom large as traders await the next shots in the US-China trade war and pressure on emerging market currencies continues. Retail trader sentiment has become more favorable […]

Jobs +201,000 Vs Employment -423,000: Another BLS Divergence

Sep 07, 2018

Jeremy Parkinson

Finance, No picture

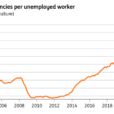

Nonfarm jobs rose but actual employment fell in two different measures of the BLS July jobs report. Initial Reaction Today’s establishment survey shows jobs rose by 201,000. Revisions were negative. The household report posted much weaker results than the establishment survey. The number employed fell by 423,000. The unemployment rate, a household survey measure, was […]

RecessionAlert Weekly Leading Index Update – Friday, September 7

Sep 07, 2018

Jeremy Parkinson

Finance, No picture

The latest index reading came in at 20.7, up from 19.5 the previous week. RecessionAlert launched an alternative to ECRI’s Weekly Leading Index Growth indicator (WLIg). The Weekly Leading Economic Index (WLEI) uses fifty different time series from these categories: Corporate Bond Composite, Treasury Bond Composite, Stock Market Composite, Labor Market Composite, Credit Market Composite. RecessionAlert emphasizes that […]

Gold Rebound Fizzles Amid Upbeat U.S. Non-Farm Payrolls (NFP) Report

Sep 07, 2018

Jeremy Parkinson

Finance, No picture

GOLD TALKING POINTS Gold prices are back under pressure as fresh updates to the U.S. Non-Farm Payrolls (NFP) report boost bets for higher interest rates, and the precious metal may continue to lose ground ahead of Fed meeting on tap for later this month as the central bank is widely expected to raise the benchmark interest […]

Dollar Dominates As Americans Get A Fatter Paycheck

Sep 07, 2018

Jeremy Parkinson

Finance, No picture

The Non-Farm Payrolls report for August 2018 was upbeat. The US Dollar took advantage of it, in a much needed straightforward reaction. The odds of a rate hike in December have risen. US wages rose 0.4% MoM in August, double the early expectations. The broader YoY measure shows an acceleration from 2.7% to 2.9%, also […]