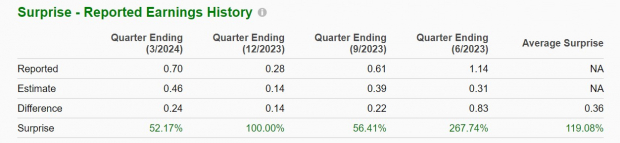

3 Intriguing Stocks To Buy After Beating Q1 Earnings Expectations

May 03, 2024Jeremy Parkinson0

Several top-rated Zacks stocks are standing out after exceeding their first quarter earnings expectations earlier in the week and could certainly move higher.Even better, their upside potential looks more promising as the Fed dismissed the possibility of rate hikes and added momentum to markets. That said, after blasting EPS estimates on Tuesday, here are three […]

Traders Are Delusional If They Think This Bad Jobs Report Is Any Good

May 03, 2024Jeremy Parkinson0

Image Source: PixabayNo matter how you slice it, we’ve had an extraordinarily volatile week; stocks were reeling like so many drunks from data to the Fed to earnings to data. Apple (AAPL), a juggernaut of the S&P 500, took off on an earnings miss yesterday because, “Hey – no worries, $110 billion in buybacks are coming.” […]

Investors Re: Rate Cuts – “So You’re Telling Me There’s A Chance”

May 03, 2024Jeremy Parkinson0

Image source: PixabayINVESTORS AND RATE CUTSWhen it comes to cuts in interest rates, investors stubbornly cling to the notion that “no” means “yes”. In the movie, Dumb And Dumber, Lloyd Christmas (Jim Carrey) asks the lovely lady he is pursuing what the odds are that the two of them might get together; and, makes a point […]

Here’s Why These Tech ETFs Are Worth Buying Now

May 03, 2024Jeremy Parkinson0

Image Source: PixabayThe technology sector suffered big losses last month due to a decline in mega-cap market caps. The stocks in the sector dragged down the S&P 500 index with the biggest monthly decline of 3.6%, per FactSet data.The delayed prospect of rate cuts, sell-off in semiconductor stocks, and bouts of weak earnings reports from tech […]

Apple Dividend Increase

May 03, 2024Jeremy Parkinson0

Image Source: PixabayApple (AAPL) increased its quarterly dividend by 4.17%, from 24¢ to 25¢ per share.The dividend will be paid on 16 May to shareholders of record on 13 May. The ex-dividend date is 10 May.AAPL’s contribution to DivGro’s projected annual dividend income will increase by $4 to $100.I own 100 shares of AAPL at an average cost basis […]

Inflation Brewing: Is Coffee The Next Cocoa?

May 03, 2024Jeremy Parkinson0

Image Source: PixabayCocoa prices have dumped since rocketing to a dramatic peak last month as an El Nino cycle winds down and traders rush out of the illiquid market. For now, depreciating fiat currencies are still keeping the cocoa price still far above its 2023 levels. Coffee has had a similar rise and subsequent correction — but now, inflation and other factors are conspiring […]

Top 5 Momentum Stocks For May After A Disappointing April

May 03, 2024Jeremy Parkinson0

Image: BigstockApril is historically known as being favorable to Wall Street investors. But this year, April ended on a disappointing note. A sticky inflation rate, a resilient labor market, and a significant decline in the U.S. GDP growth rate dented market participants’ confidence in risky assets like equities.The Dow plunged 5%, marking its worst monthly […]

Cybercriminals Are Using AI, Now Security Firms Are Too

May 03, 2024Jeremy Parkinson0

Photo by Steve Johnson on UnsplashBeing a hacker used to mean you knew how to code. Not anymore. ChatGPT made it possible for anyone to whip up malware just by asking the AI to write a program for them. No coding experience required.It’s also helping hackers create more convincing phishing emails to trick people into revealing sensitive information […]

Costco Dividend Stock Analysis

May 03, 2024Jeremy Parkinson0

Image Source: PixabayDividend stocks are shares in companies that reward investors with regular payouts, which can be used to supplement their income, cover living expenses, or reinvest in their stock portfolio.Some factors set certain dividend stocks apart from others, such as dividend history, growth, yield, and payout ratio. Additionally, companies that continue to grow earnings and […]

ETFs To Buy On Apple’s Q2 Earnings Beat, Largest-Ever Buyback

May 03, 2024Jeremy Parkinson0

Image: BigstockApple Inc. (AAPL – Free Report) reported robust second-quarter fiscal 2024 results, wherein it beat estimates on both earnings and revenues. The iPhone manufacturer lifted its dividend payments and unveiled a record share buyback program amid the steep decline in iPhone sales.Bolstered by the increased dividend and stock repurchase commitment, Apple shares jumped as much as […]