Tesla Launch Could Be Biggest Trucking Catalyst In Decades, Says Morgan Stanley

Sep 06, 2017Jeremy Parkinson0

Morgan Stanley analyst Ravi Shanker contends that Tesla’s (TSLA) promised upcoming reveal of its autonomous, electric Class 8 semi-truck could be the biggest catalyst in the trucking sector in decades. While no exact date has been announced yet, Tesla CEO Elon Musk said the reveal will come in September and Shanker thinks the NACV show […]

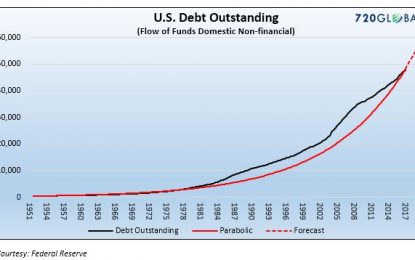

Consumption Exhaustion

Sep 06, 2017Jeremy Parkinson0

When people use the word catalyst to describe an event that may prick the stock market bubble, they usually discuss something singular, unexpected and potentially shocking. The term “black swan” is frequently invoked to describe such an event. In reality, while such an incident may turn the market around and be the “catalyst” in investors […]

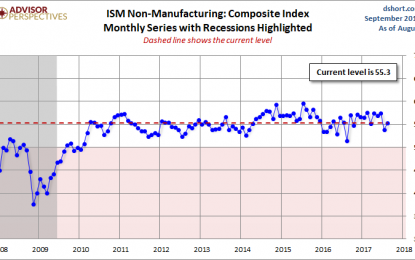

ISM Non-Manufacturing: Continued Growth In August

Sep 06, 2017Jeremy Parkinson0

The Institute of Supply Management (ISM) has now released the August Non-Manufacturing Purchasing Managers’ Index (PMI), also known as the ISM Services PMI. The headline Composite Index is at 55.3 percent, up 1.4 from 53.9 last month. Today’s number came in below the Investing.com forecast of 55.4 percent. Here is the report summary: “The NMI® registered 55.3 percent, […]

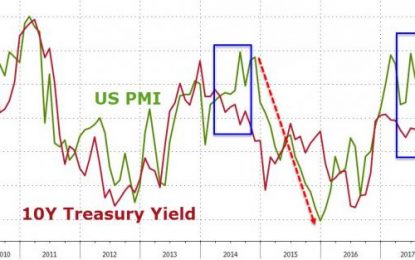

Bonds Ain’t Buying What PMIs Are Selling

Sep 06, 2017Jeremy Parkinson0

US survey-based PMIs have surged to their highest levels since April 2011 in the last few months, seemingly signifying to all that the US economy is chugging along nicely and escape-velocity-driven nirvana is right around the corner. There’s just one thing… the bond market is calling bullshit! The last time this kind of decoupling happened was in […]

Firm Founders Have Moved On; Investors Should Also

Sep 06, 2017Jeremy Parkinson0

This firm was once at the forefront of a new industry, but commoditization of its core product and lack of innovation has resulted in management’s attempt to re-invent the company through acquisitions. Profit growth expectations embedded in the stock price are likely unfeasible in light of current financial performance and formidable competitive challenges. We think […]

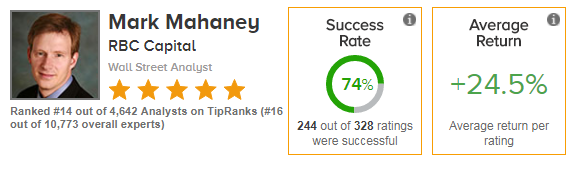

RBC Capital: 3 Hot Stock Picks To Rally In The Valley

Sep 06, 2017Jeremy Parkinson0

Top RBC Capital analyst Mark Mahaney has just completed a tour of Silicon Valley’s hottest internet companies. TipRanks shows that five-star Mahaney is a top analyst to follow. As we can see here, his ranking of #14 out of 4,642 analysts is based on an impressive 74% success rate and 24.5% average return. We took this opportunity to review […]

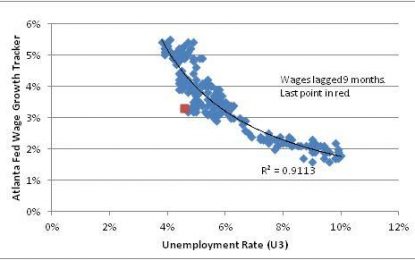

Some Further (Minor) Thoughts On The Phillips Curve

Sep 06, 2017Jeremy Parkinson0

Before I begin, let me say that if you haven’t read yesterday’s article, please do because it represents the important argument: the Phillips Curve doesn’t need rehabilitating because it is working fine. In fact, I would argue that the Phillips Curve – relating wages to unemployment – is a remarkably accurate economic model prediction. The key chart from that article […]

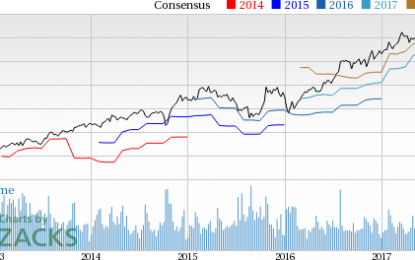

Bull Of The Day: Texas Instruments (TXN)

Sep 06, 2017Jeremy Parkinson0

Headquartered in Dallas, Texas, Texas Instruments (TXN – Free Report) is a global semiconductor company and an original equipment manufacturer of analog, mixed signal and digital signal processing (DSP) integrated circuits. Their chips are used in everything from mobile phones to industrial equipment and many smart products. The company has about 30,000 employees in more than 30 countries and […]

USD/CAD Runs Into Multi-Year Trend-Line Ahead Of Bank Of Canada

Sep 06, 2017Jeremy Parkinson0

Today brings a widely-watched Bank of Canada rate decision, in which there is a legitimate chance of getting another rate hike after the BoC’s move in July. That rate hike in July was the first in seven years, and already markets have built-in the heavy expectation for another. If the BoC doesn’t hike today, October […]

“We’re Now Seeing Bubbles Everywhere” – Deutsche Bank Boss Urges End To “Era Of Cheap Money”

Sep 06, 2017Jeremy Parkinson0

The head of Germany’s largest commercial bank warned of the fallout from cheap money, cautioning against using the strong euro as a justification for printing more. Bloomberg reports that the Deutsche Bank Chief Executive Officer John Cryan called for an end to the era of cheap money in Europe, saying that the prolonged period of rock-bottom interest rates is starting […]