Hewlett Packard Has A Big Amazon Problem

Sep 06, 2017Jeremy Parkinson0

I joined CNBC this evening to chat about Hewlett Packard Enterprise’s (HPE) latest earnings announcement. Hewlett Packard Enterprise investors got some much-needed good news today, as the company beat third quarter estimates. Shares are up over 4% after hours. Earnings came in at 31 cents per share, better than the 26 cents expected by analysts. Revenue also beat […]

Ride Out The VIX Spike With These 5 Low Beta Stocks

Sep 06, 2017Jeremy Parkinson0

On Tuesday afternoon, the CBOE Volatility Index surged more than 38% to hit 14. Driving the ascent of the VIX was a trifecta of factors. While tensions over North Korea continued to escalate, markets were visited by familiar concerns over a policy paralysis in Washington. Meanwhile, news that a new category 5 hurricane, Irma, has […]

ISM Services Rises Less Than Expected

Sep 06, 2017Jeremy Parkinson0

After last week’s ISM Manufacturing report came in at a six-plus year high, the current environment for the larger services sector was not nearly as strong. While Wednesday’s release of the ISM Non-Manufacturing report for the month of August did improve to 55.3 relative to July’s reading of 53.9, the rebound was not as strong […]

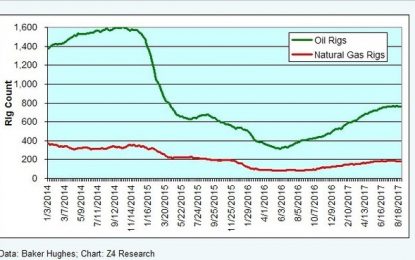

Oil Drillers – Attempting Bullish Breakout

Sep 06, 2017Jeremy Parkinson0

Oil Drillers have had little to smile about over the past years. Could this trend be about to end? A pattern is in play that highlights a counter trend rally could be near. Below looks at the Oil Drillers (XOP)/ S&P 500 Ratio over the past couple of years. The ratio could be creating a double […]

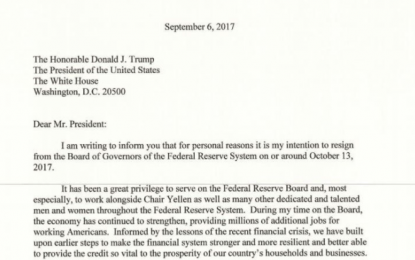

Stanley Fischer Resigns As Fed Vice-Chair

Sep 06, 2017Jeremy Parkinson0

Developing… Ok, and now Fischer is resigning… FED VICE CHAIRMAN FISCHER RESIGNS, EFFECTIVE MID-OCTOBER He’s citing “personal reasons.” “Stan’s keen insights, grounded in a lifetime of exemplary scholarship and public service, contributed invaluably to our monetary policy deliberations,” Yellen says. “He represented the Board internationally with distinction and led our efforts to foster financial stability.” […]

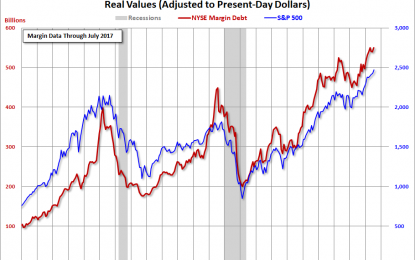

A Look At NYSE Margin Debt And The Market – Wednesday, September 6

Sep 06, 2017Jeremy Parkinson0

Note: The NYSE has released new data for margin debt, now available through July. The New York Stock Exchange publishes end-of-month data for margin debt on the NYX data website, where we can also find historical data back to 1959. Let’s examine the numbers and study the relationship between margin debt and the market, using the S&P […]

In One Sense, This Company’s Huge Success Makes No Sense

Sep 06, 2017Jeremy Parkinson0

TM editors’ note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence. In one sense, this makes NO sense: Aveda Transport and Energy Services (AVE-TSX)(PHNHF) hit record revenue (US$52 million) and record positive cash flow (just over $5 million) this last quarter, Q2 17. I […]

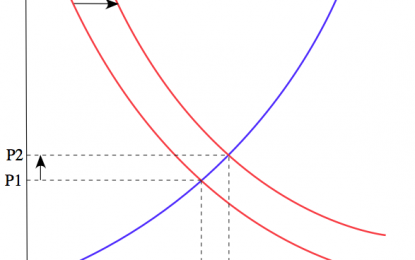

Why Oil Prices Can’t Bounce Very High; Expect Deflation Instead

Sep 06, 2017Jeremy Parkinson0

Economists have given us a model of how prices and quantities of goods are supposed to interact. Unfortunately, this model is woefully inadequate. It sort of works, until it doesn’t. If there is too little a product, higher prices and substitution are supposed to fix the problem. If there is too much, prices are supposed […]

Global Equity Fundamentals And The “Mini-Recession”

Sep 06, 2017Jeremy Parkinson0

In this video, we look at the key trends in global equity fundamentals. The video walks through a couple of slides of a recent edition of the Weekly Macro Themes report. In the video, we look at a couple of charts which track the broader trends in profit margins across the more than 40 countries that […]

Gold Has Risen In 14 Of The Past 17 Years, Far Surpassing Returns From Stocks

Sep 06, 2017Jeremy Parkinson0

Here’s a recent quote from Fred Hickey of The High-Tech Strategist: “Including this year [as of 2 September], gold has risen in 14 of the past 17 years at a 9.4% compound annual rate, far surpassing returns from stocks. That’s why I still contend we’re in a long, secular bull market (driven by the central bank […]