USDCAD Daily Analysis – Friday, August 25

Aug 25, 2017Jeremy Parkinson0

USDCAD’s short term downtrend from 1.2778 extended to as low as 1.2505. As long as the price is in the falling price channel on the 4-hour chart, the downtrend could be expected to continue and deeper decline to test 1.2413 support is possible. On the upside, a clear break above the top trend line of […]

US Dollar May Rise As Euro Falls On Yellen, Draghi Speeches

Aug 25, 2017Jeremy Parkinson0

Currency markets put in a muted performance in Asia Pacific trade as investors looked ahead to headlines emerging from the Fed’s annual monetary policy symposium underway in Jackson Hole, Wyoming. Traders are most keen to hear comments from Fed Chair Janet Yellen and ECB President Mario Draghi, both of which may set the stage for major policy changes. […]

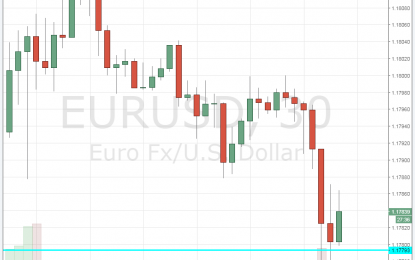

German IFO Business Climate Beats With 115.9 – EUR/USD Rises

Aug 25, 2017Jeremy Parkinson0

Business confidence remains elevated in Germany. IFO’s business climate makes a minor slide from 116 to 115.9, better than 115.5 predicted. Business expectations advanced from 107.3 to 107.9, defying projections for a fall. The Current Assessment measure dropped from 125.5 to 124.6. EUR/USD is moving up a few pips, erasing the previous slides. The bigger […]

Trouble Financing Its Debt: Massive Decline Rates Push U.S. Shale Oil Industry Closer Towards Bankruptcy

Aug 25, 2017Jeremy Parkinson0

The U.S. Shale Oil Industry is in serious trouble as its debt spirals higher due to its massive production decline rates. While the mainstream media continues to put out hype that the shale oil industry can produce oil at $30 or $40 a barrel, the reality shows that it’s becoming difficult just to finance its […]

This Hasn’t Happened To The Yuan Since July Of 2014

Aug 25, 2017Jeremy Parkinson0

It’s probably time to start watching for some kind of move from the PBoC to put a lid on yuan strength. We’ve talked a ton about the fact that since the engineered short squeeze in late May/early June (an effort that included the introduction of a new “counter-cyclical adjustment factor” designed to give the PBoC […]

Why Janet Yellen Is About To Hate Bacon

Aug 25, 2017Jeremy Parkinson0

For 99.9999% (our estimate) of Americans, there is great news on the way – retail bacon prices are about to plummet. However, with food accounting for 14% of CPI, we suspect the pork-price-pounding is about to become Janet Yellen’s new ‘transitory’ problem. In the first half of the year, the best performing commodity in the tradable universe […]

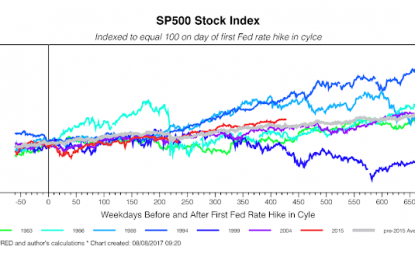

E Tim Duy: Stocks Won’t Crash; Look For These Indicators

Aug 25, 2017Jeremy Parkinson0

Tim Duy says stocks won’t likely crash. He has a chart showing the behavior of our current stock cycle. And he has a set of leading indicators to look for down the road. Tim is very consistent in his pronouncements. He does not see stocks taking the economy down: But if not market valuations, what should be the […]

Have We Learned Nothing From The Financial Crisis?

Aug 25, 2017Jeremy Parkinson0

One of the hottest ‘Trump triumph trades’ late last year was the financial sector. Banks stocks soared in the immediate aftermath of the election leaving some to question why they were so strong. Typically, the banks’ relative performance to the S&P 500 is highly correlated to the yield curve and this makes sense. When the […]

Gold Prices May Fall As Yellen Speaks At Jackson Hole Symposium

Aug 25, 2017Jeremy Parkinson0

Commodity prices remain locked in familiar ranges as financial markets await direction cues from the Fed’s annual policy symposium underway in Jackson Hole, Wyoming. A much-anticipated speech from Chair Janet Yellen takes top billing. Traders are looking for comments signaling the imminent start so-called “quantitative tightening” (QT) – the unwinding of the US central bank’s bloated post-crisis […]

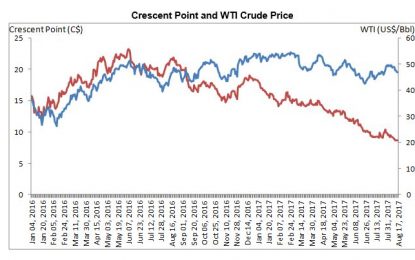

Crescent Point Energy, Inc. Trading At A Discount To Its Peers Despite Its High-Quality Oil & Natural Gas Assets

Aug 24, 2017Jeremy Parkinson0

Written by SmallCapPower.com Crescent Point Energy Corp. (CPG) is a conventional oil and gas producer with high-quality light and medium oil and natural gas assets across western Canada and the U.S. Unlike other oil and gas stock prices, which typically mirror the underlying oil price, the share price of Crescent Point Energy is trading much […]