We See Abundant Fixed Income Opportunities – Here Are 2 Reasons Why

Mar 11, 2017Jeremy Parkinson0

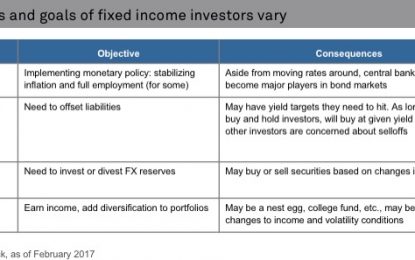

Skeptics of the active approach often cite this argument: With information more and more readily available, markets are becoming ever more efficient and true alpha (or active return) is increasingly difficult to find. We don’t believe that this is true today in fixed income markets. Indeed, we see abundant opportunities for active bond investors for […]

Anchoring

Mar 11, 2017Jeremy Parkinson0

How we think and the way that we perceive information can have a powerful impact on our decisions. Often, the first piece of information we receive is what we will use for future reference when making decisions – and whether we feel those decisions are good or bad. This is referred to anchoring or anchoring […]

Market Doubts Of Three Fed Hikes This Year Caps Dollar

Mar 11, 2017Jeremy Parkinson0

Bringing forward expectations of a Fed hike from May-June to March was worth something for the dollar, but to get more now, the market may need to recognize the risk of three (or more) hikes this year. With the strong February jobs growth and a 2.8% year-over-year increase in hourly earnings, rarely does the market’s […]

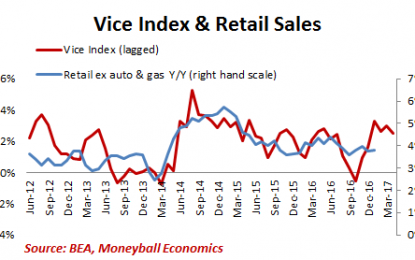

Vice Index: Retail Spending Pace Is Beginning To Peak

Mar 11, 2017Jeremy Parkinson0

Retail Spending Pace is Peaking Vice Index points to steady consumer spending… But it is going to slow in the next few months. The nominal spending level continues to expand (more people are entering the workforce and wages are growing). But it’s growing at a slower pace. This month will see a favorable year-over-year (yr/yr) […]

NextEra Energy: Diversified Utility, Dividend Achiever

Mar 11, 2017Jeremy Parkinson0

NextEra Energy (NEE) isn’t your run-of-the-mill utility. It has a heavy focus on renewable energy like wind, nuclear, and solar. It generates more than $16 billion of revenue, and has nearly 46,000 megawatts of generating capacity. It has more than 14,000 employees in 30 U.S. states and Canada. NextEra is also an uncommon stock in […]

The 10-Year Bond Hits Bill Gross’s 2.60% Target

Mar 11, 2017Jeremy Parkinson0

We are in an interesting time for equity investing because productivity is stuck in a rut, yet stocks are levitating higher. Since productivity growth drives economic growth, there’s no way stocks can rally in the long-term without it. I think both will correct as productivity growth will likely revert to the mean, possibly due to […]

La Grande Image

Mar 11, 2017Jeremy Parkinson0

Hey, guess what – – – I’m bearish on equities. Surprise, surprise, surprise! Allow me to share a few charts to support my point of view. First up is the Russell 2000, which has broken the midline of its channel. It seems to me a trek down to the supporting (lower) trendline is the next […]

No Paradox, Economy To Debt To Assets

Mar 11, 2017Jeremy Parkinson0

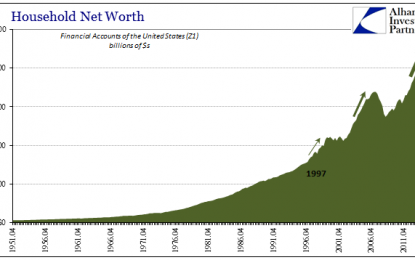

It is surely one of the primary reasons why many if not most people have so much trouble accepting the trouble the economy is in. With record high stock prices leading to record levels of household net worth, it seems utterly inconsistent to claim those facts against a US economic depression. Weakness might be more […]

Successful And Unsuccessful Strategies

Mar 11, 2017Jeremy Parkinson0

Markets don’t behave the same way now that they did 10 or 15 years ago. Buying breakouts or waiting for confirmation of a trend change, these days, is usually a nonsensical strategy. The strategy that is more successful these days is to buy bottoms – using a couple of different techniques. Video Length – 00:09:12

FV Rare And Rapid Shift In This Signal

Mar 11, 2017Jeremy Parkinson0

Indicator Flips (1982-2017) Video Length – 00:29:09