How To Ride An Aging Bull

Dec 01, 2014Jeremy Parkinson0

Yesterday marked the fifteenth time I have served as a guest columnist for The Striking Price at Barron’s and How to Ride an Aging Bull is one of the few articles I have written for Barron’s that has not focused almost exclusively on the VIX and volatility. In the Barron’s article I note that pundits have been calling this […]

The Oil-Drenched Black Swan, Part 1

Dec 01, 2014Jeremy Parkinson0

Given the presumed 17% expansion of the global economy since 2009, the tiny increases in production could not possibly flood the world in oil unless demand has cratered. The term Black Swan shows up in all sorts of discussions, but what does it actually mean? Though the term has roots stretching back to the 16th century, today it […]

Investors That Do Not Understand The Power Of Seven Will Lose Money In 2015

Dec 01, 2014Jeremy Parkinson0

Investors and traders around the world continually search to find or increase their edge in the financial markets to boost profits. The next few months are going to be critical for investors because the number seven is now in play for the stock market. What does this mean? In magical lore seven is a magical […]

Milton Friedman Was Wrong. Inflation Is Not Always A Monetary Phenomenon

Dec 01, 2014Jeremy Parkinson0

I have a lot of respect for the late Milton Friedman. I really do. His unapologetic defense of the free market was–and still is–a breath of fresh air amidst the constant drone of calls for the government to “do something” to fix all of our problems, real or imagined. But on the subject of inflation–the […]

Falling Oil Prices, Holiday Shopping Point North For U.S. Recovery

Dec 01, 2014Jeremy Parkinson0

This past week markets hit new highs on Wednesday, only to pull back a bit on OPEC’s decision to hold steady on production quotas. OPEC is in crisis because two of the three biggest oil producers—Russia and the United States—don’t participate in its market rigging activities. With Russia buffeted by sanctions and desperate for revenues and […]

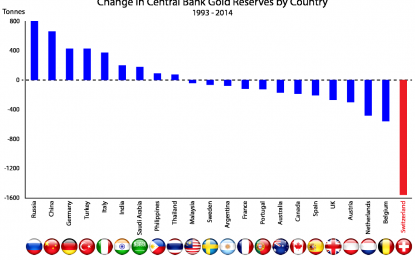

Switzerland Leads In Gold Sales Among Central Banks Since 1993

Dec 01, 2014Jeremy Parkinson0

Although they are still among the top ten in total gold holdings, Switzerland has been one of the largest sellers of gold among official entities since 1993. It is no surprise then that the people of Switzerland have taken to a referendum to provide their opinions on this to the Swiss National Bank. With regard to […]

E EC Three Things To Avoid As An Amateur Stock Picker

Nov 30, 2014Jeremy Parkinson0

In 2008, I was living in a tiny, dirty efficiency apartment in the worst part of my town. I couldn’t even afford cable. I ate a chicken breast every night for dinner, and most of the time, skipped breakfast and lunch. I was poor. But six years later, I make more money than any of […]

E Stock World Weekly: Politics Of Oil And Price Wars

Nov 30, 2014Jeremy Parkinson0

In the latest Stock World Weekly, we discuss oil prices, OPEC, econo-politics and more; and Phil provides several trade ideas including one with USO. (Read the newsletter by clicking here and trying PSW free.) Excerpt: Reasons for the continuous drop in oil prices are clear: booming US production, declining demand in many regions including Japan, China and Europe, […]

Italy’s Temporary “Glass Half Full” Insanity

Nov 30, 2014Jeremy Parkinson0

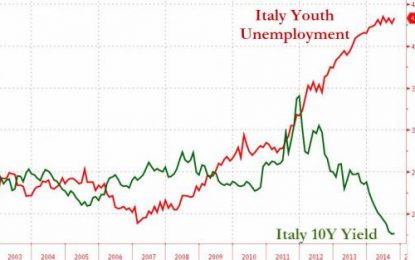

Yesterday it was the French, with record high unemployment and record low bond yields. Today, it is the turn of the Italians as the unemployment rate rose to 13.2% – the highest since records began – as bond yields continue to plumb new “lower rates will spur lending which will spur economic growth which will create jobs” […]

What Happened To The Gold Correlation

Nov 30, 2014Jeremy Parkinson0

The correlation between gold and the national debt was clear for 13 years. It made perfect sense in a free market. You can’t print more gold. It is a relatively scarce metal that has represented wealth for centuries. Fiat currency can be printed at will by corrupt bankers and politicians. Every paper currency ever created eventually reached […]