Macro: Retail Sales — Nice Rebound

Dec 18, 2023Jeremy Parkinson0

Image Source: PixabayThis was a really good number. It was partially a rebound from October. Non-store retailers were a big area of strength. I do think some holiday sales were pulled forward. Regardless, December is an easy comp, so next month’s release should again be fine. Year over year sales grew 4.1%. Consumer strength continues.More By […]

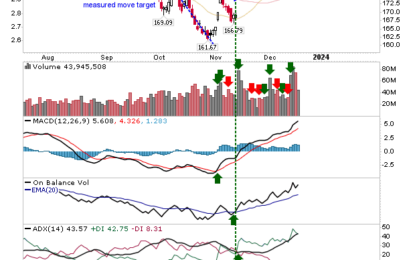

The Russell 2000 Is Ready To Fill Last Week’s Gap

Dec 18, 2023Jeremy Parkinson0

“Black” candlesticks are rarely good and we had one today in the Russell 2000 (IWM). The expectation is for an open below today’s close, and then a close lower than the open. As part of this bearish setup I will be looking for a gap closure that may result in a bullish ‘hammer’, but more […]

Gasoline Prices Continue Downward

Dec 18, 2023Jeremy Parkinson0

Image Source: PixabayLast week, I was asked about the likely future trajectory. As of the week ending today, prices still falling (from $3.23 to $3.14).On WPR, I noted that we should enjoy it while we can: Falling gas prices also help bring down inflation. “If oil prices are going to stay at the levels that they are, […]

Streamlined Portfolio Strategy: Fewer Baskets, Sharper Focus

Dec 18, 2023Jeremy Parkinson0

Image Source: PixabayIf I were to characterize the nature of my portfolio currently, it would be like the old saying: “Put all your eggs in one basket and watch that basket.” Well, ok, it’s three baskets. Instead of having dozens of positions based on individual equities, I’ve changed to a very small number of ETFs. I wanted to […]

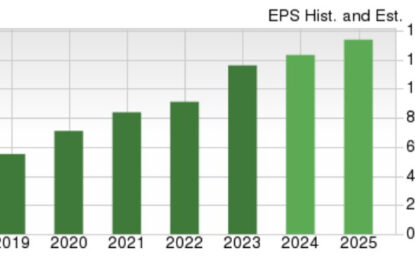

3 Highly Ranked Retail Stocks To Buy At Year’s End

Dec 18, 2023Jeremy Parkinson0

As we start to round out the year, retail stocks may become more of a focal point for investors’ portfolios in 2024. To that point, a more dovish Fed is starting to allude to the notion that inflation will be easier on consumers going forward and a few Zacks Retail and Wholesale sector stocks are […]

“Pivot Party” Keeps Holiday Season Rolling

Dec 18, 2023Jeremy Parkinson0

Image Source: PixabayIt’s the holiday season, so why not keep the party going? ’Tis the season, and so forth — right? In the market’s case, call it a “pivot party,” which got started last Wednesday afternoon as the Federal Open Market Committee (FOMC) concluded monetary policy keeping interest rates steady with a press conference featuring Fed […]

Gold Price Forecast: XAU/USD Remains Range-Bound Below $2,030, US Housing Data Eyed

Dec 18, 2023Jeremy Parkinson0

Image Source: Pixabay Gold price remains clings to the range-bound theme around $2,025 on the softer USD. The Federal Reserve (Fed) indicated that it will begin monetary policy easing after data showed declining inflation. Gold traders will focus on the US housing data on Tuesday. Gold price (XAU/USD) sticks to the range-bound theme near $2,025 during […]

Macro: NY Fed Regional Surveys

Dec 18, 2023Jeremy Parkinson0

Image source: Pixabay The Empire State Manufacturing Survey showed declining activity in December after a positive November. It is also still showing declining future orders. Services in NY region also showing declining activity but also some optimism for the beginning of 2024. More By This Author:Macro: Initial Claims — Strong Employment Translating To Consumption Year-End Financial […]

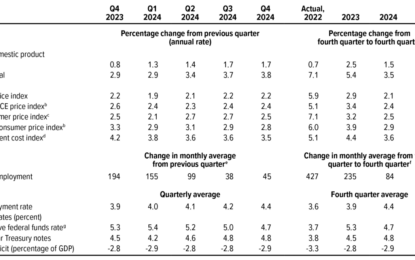

CBO On The Economic Outlook: No Downturn, Higher Rates

Dec 18, 2023Jeremy Parkinson0

From CBO’s Current View of the Economy From 2023 to 2025: Compared with its February 2023 projections, CBO’s current projections exhibit weaker growth, lower unemployment, and higher interest rates in 2024 and 2025.2 The agency’s current projections of inflation are mixed relative to those made in February 2023. Table 1 summarizes: CBO’s path for GDP looks […]

Market Talk – Monday, Dec. 18

Dec 18, 2023Jeremy Parkinson0

ASIA:The major Asian stock markets had a mixed day today: NIKKEI 225 decreased 211.57 points or -0.64% to 32,758.98 Shanghai decreased 11.75 points or -0.40% to 2,930.80 Hang Seng decreased 162.96 points or -0.97% to 16,629.23 ASX 200 decreased 16.30 points or -0.22% to 7,426.40 Kospi increased 3.30 points or 0.13% to 2,566.86 SENSEX decreased […]