EUR/USD Analysis: Bulls Await More Stimulus

Apr 30, 2024Jeremy Parkinson0

Overall, selling pressure reminds us that this exchange rate is in a technical downtrend, and any strength should be considered short-term. US dollar buyers should be ready to jump on these comfortable highs. Overall, we note that the EUR/USD price broke below the 1.0711 level on Friday, which constitutes the 61.8% Fibonacci retracement of the late 2023 and early […]

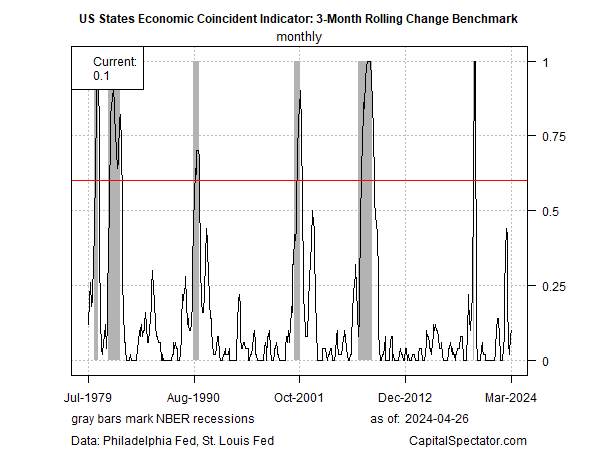

US Recession Warning Via States Economies Was A False Alarm

Apr 30, 2024Jeremy Parkinson0

The value of modeling recession risk based multiple indicators is a hardy perennial. The latest example comes by way of aggregating trends in the 50 US state economies for estimating the odds that a NBER-defined downturn has started or is imminent. As recently as February this indicator looked ominous. But as the latest updates show, the warning turned out […]

GBP/JPY Forecast: Massive Moves Against Yen

Apr 30, 2024Jeremy Parkinson0

GBP/JPY is a market that is getting out of control and volatility is probably going to continue to pick up. But at this point in time, the trend is still very positive. And that’s something that you’re going to have to be cognizant of. With that being the case, I have no interest in trying to get to […]

Nasdaq 100 Commentary – Tuesday, April 30

Apr 30, 2024Jeremy Parkinson0

Nasdaq Higher Ahead of Next Tech EarningsThe Nasdaq continues its attempted recovery this week with price testing back above the 17693.37 level, having bounced off support at the 16982.40 level. The index has suffered in recent weeks as a hawkish shift in Fed expectations has pushed USD higher. Additionally, some downside in big tech names […]

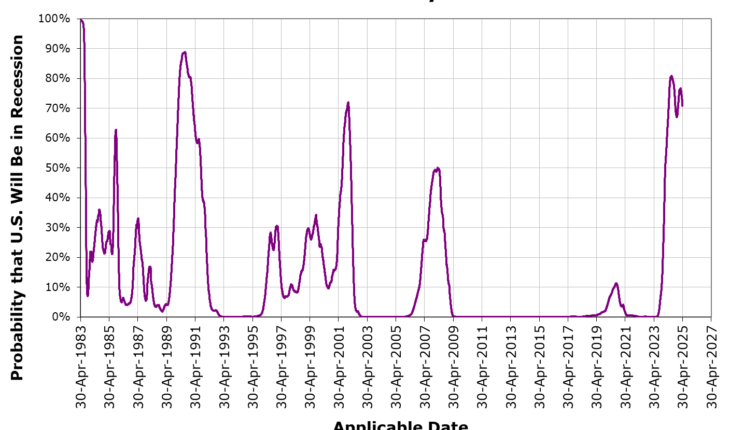

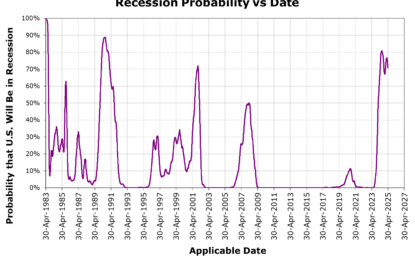

Recession Probability Falls After Hitting Double-Top

Apr 30, 2024Jeremy Parkinson0

The probability the U.S. economy will see a recession begin sometime in the next twelve months has started to fall again during the past six weeks. after having hit a double-top.Since our previous update, the probability has dropped from over 76% to just under 71%, confirming the double-top after having previously peaked at 81% in July 2023.These […]

Unlocking ASX Trading Success: REA GROUP LTD – REA Stock Analysis & Elliott Wave Technical Forecast

Apr 30, 2024Jeremy Parkinson0

ASX: REA GROUP LTD – REA Elliott Elliott Wave Technical Analysis TradingLounge (1D Chart)Greetings, Our Elliott Wave analysis today updates the Australian Stock Exchange (ASX) with REA GROUP LTD – REA. We identified that wave 2-red may have just ended, and wave 3-red could push much higher.ASX: REA GROUP LTD – REA Elliott Wave Technical Analysis ASX: REA GROUP […]

French Inflation Slowly Continues To Moderate

Apr 30, 2024Jeremy Parkinson0

Image Source: DepositPhotosConsumer price inflation in France stood at 2.2% in April compared with 2.3% in March, while the harmonised index remained stable at 2.4%. We think inflation could rise again in the coming months. Disinflation easesConsumer price inflation in France stood at 2.2% in April compared with 2.3% in March. This fall in inflation was due […]

USD/CAD Price Analysis: Hovers Near 1.3700 Within The Ascending Channel

Apr 30, 2024Jeremy Parkinson0

USD/CAD consolidates within the ascending channel on the daily chart, with the 14-day Relative Strength Index (RSI) positioned above 50, indicating a recovery of bullish sentiment. The pair edges higher to near 1.3700 during the European session on Tuesday.Moreover, the Moving Average Convergence Divergence (MACD) line is above the centerline, signaling bullish momentum, although it remains below […]

Bitcoin Commentary – Tuesday, April 30

Apr 30, 2024Jeremy Parkinson0

Bitcoin Remains MutedIt’s been a disappointing week for Bitcoin bulls with the leading crypto asset seen lower on the back of the April halving event. There had been plenty of speculation ahead of the event regarding the potential for a fresh rally on the back of supply being reduced. However, this upside has yet to […]

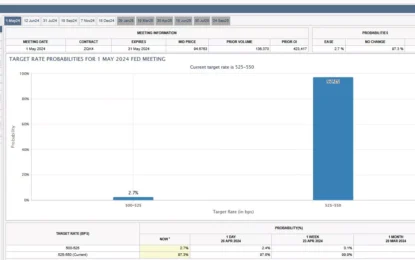

Tuesday Talk: Market Stays Up Awaiting FOMC Meeting

Apr 30, 2024Jeremy Parkinson0

The likelihood of any reduction in interest rates is low as the market awaits the commencement of the upcoming FOMC meeting. CME data shows that 97.3% of respondents believe that rates will stay the same. On Monday the S&P 500 closed at 5,116, up 16 points, the Dow closed at 38,386, up 146 points, and the […]