As the US winds down into the holiday season, there are pressing questions about correlations and causality across markets. Most would argue that the present price action in risk assets looks ugly, with confidence failing across key sectors.

Blame for the pain trade starts with global politics and gets local with this last week bringing to the front fears about less demand for $1000 iPhones and troubles for GE as it faces significant debt rollovers into 2019. Throw in expectations for more Fed rate hikes despite equities, mix with lower oil prices and you have no joy, no glib market relief from policy-makers.

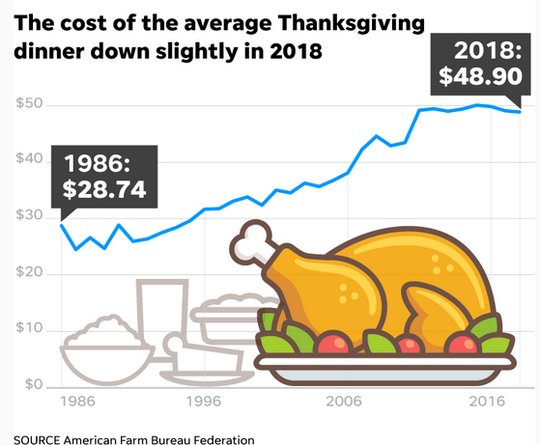

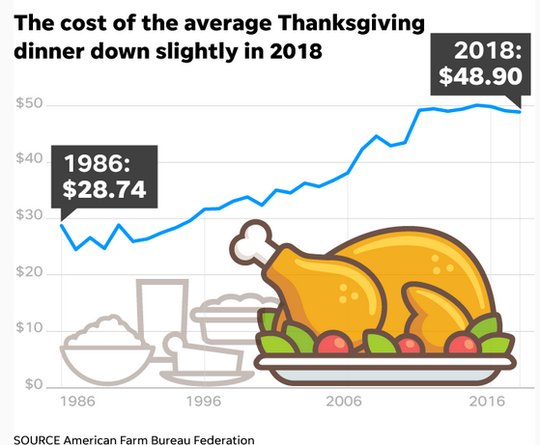

Perhaps the American Turkey, the headline part of the food feast ahead, can shed some light on how we are battling idiosyncratic events with a global culture. The bird meleagris gallopavo become known as a turkey because of Turkey – as the imports of guinea fowls that look similar to the native American bird – came from the Ottoman Empire export machine. Times have changed, exports have changed, but the role of globalization in driving interconnected supply chains hasn’t.

Fear dominated the week but greed ended it. Last week delivered fear of such from the Italian budget impasse with the EU commission, to the politics of the UK as May struggles to hold her government together after successfully crafting a deal with the EU, as the Trump administration bickers about China trade policy goals and as the economic performance of Germany and Japan suggest a larger global slowdown in play for 4Q. The last week also brought hope for a moderation in the FOMC rate hikes, progress in China/US trade deal talks, a final EU/UK Brexit plan and significantly higher volatility across markets.

The word turkey also has a derogatory slang meaning in the US – for being naïve, stupid and inept. And to think, Ben Franklin wanted to make the turkey the national bird over the bald eagle. The holiday week ahead will make many wonder if this is a turkey fest and whether the failure of markets rests on confidence in leaders or in the actual market economies with inflation and growth the key drivers.

What Happened over the Weekend?

US politics continue to hang over headlines with the battle for the House speaker race ongoing, with races in Georgia and Florida conceded to the Republicans by reluctant Democrats and with Trump facing pushback on his Saudi stance, North Korea’s new weapon test, cabinet shakeups. European politics were also in the news with Macron facing riots over fuel price hikes, Greece seeing riots break out over the 1973 anniversary, German politicians rush to replace Merkel in leadership roles.

Question for the Week Ahead: What matters the most for investors?

The list of concerns that dominated price action in the last week is well known:

The question is what of these matters the most as the risk of FOMC speeches and reactions to data in the weeks ahead of their December meeting seems high.

“As you move in the range of policy that by some estimates is close to neutral, then with the economy doing well it’s appropriate to sort of shift the emphasis toward being more data dependent,” Fed Vice Chair Clarida said during a “Squawk Box” interview last week. Similarly, as the Pence/Xi barbs from the weekend suggest, a deal in Argentina at the G20 for US/China trade is still far away. The unwind of the winners of 2018 stocks rests on value, regulation and perceptions of demand into 2019 with the FAANG reversal troubling but not surprising.