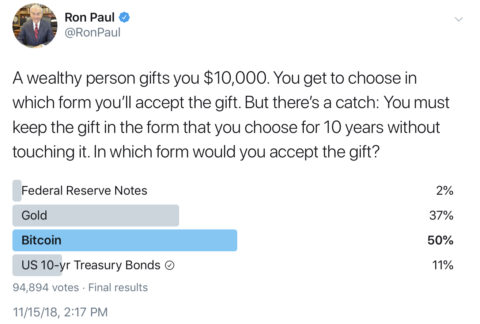

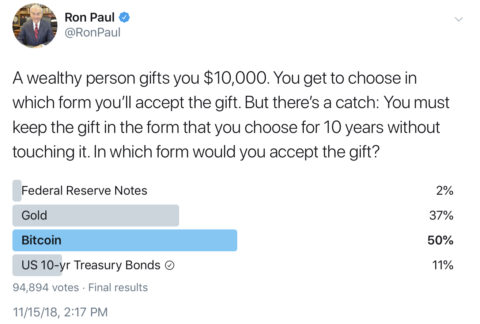

Okay, so you all know I am all about operational reality. And although the financial markets and the economy aren’t exactly like the physical world there are certain operational and fundamental aspects to it all. So, I was intrigued by this tweet by Ron Paul and the lop-sided responses:

Okay, so Ron Paul has a certain type of follower, but let’s go through this because it’s good practice.

Federal Reserve Notes

Good ‘ole cash. Nothing gives you greater optionality. Heck, you can even buy drugs with it if that’s your thing. But cash is the worst thing to hold for the long-term because it is designed not to earn any interest and that means that it is guaranteed to erode purchasing power every year. Cash can basically be thought of as an asset that gives you unparalleled near-term purchasing optionality, but gives you that optionality with the cost of losing the rate of inflation every year. So, definitely not something you want to hold onto for 10 years….

Gold

Ah, there’s gold in them thar hills! Yeah, we all know someone who has a love affair with gold. It’s pretty, has real economic utility, has a long history of being a reliable medium of exchange and has tended to maintain purchasing power.

The obvious problem with gold is that it has no cash flows. Ie, there is no fundamental reason why gold should rise in value other than its basic economic value as a commodity. That’s why I’ve always said gold is a basic commodity with a “faith put” i.e, lots of people believe gold has certain monetary or inflation protecting qualities, but those are beliefs, not fundamental to gold itself.

So, is gold a good 10 year bet? If you believe its utility as a commodity is going to surge or that it will continue to be viewed as a good inflation hedge (and that inflation is about to surge) then yes, but there’s really no fundamental reason why gold should outpace a broad basket of commodities over the long-term. And commodities, at the end of the day, ARE the cost of inflation.