How many times have you read somewhere or heard someone state the “S&P 500 is up or down X% today?” Or have you heard someone say that they own a mutual fund or ETF mirrors the S&P 500? Lastly, have you read one of our stock analyses where we compare a company’s price to the S&P 500 to determine if the company is undervalued? If you are a beginning investor, when asking those or similar questions to yourself, did you even stop and wonder what exactly the S&P 500 is?

This year, we have started our financial education series where we educate investors of all experience levels about various topics.We’ve covered topics such as Who and What Is Vanguard?, What is the Dividend Payout Ratio?, and What is a Dividend? In this article, we will take a deeper dive into the S&P 500, explain what the stock market index is, provide a background, and review how the S&P 500 determines which stocks are included in the index.

What is the S&P 500?

Let’s start with the Investopedia.com definition: “The S&P 500 Index (formerly Standard & Poor’s 500 Index) is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies by market value. The index is widely regarded as the best single gauge of large-cap U.S. equities.” To simplify it, the S&P 500 is a basket of 500 companies that are weighted based on the market caps of the companies included in the index.The companies included are all large-cap stocks.

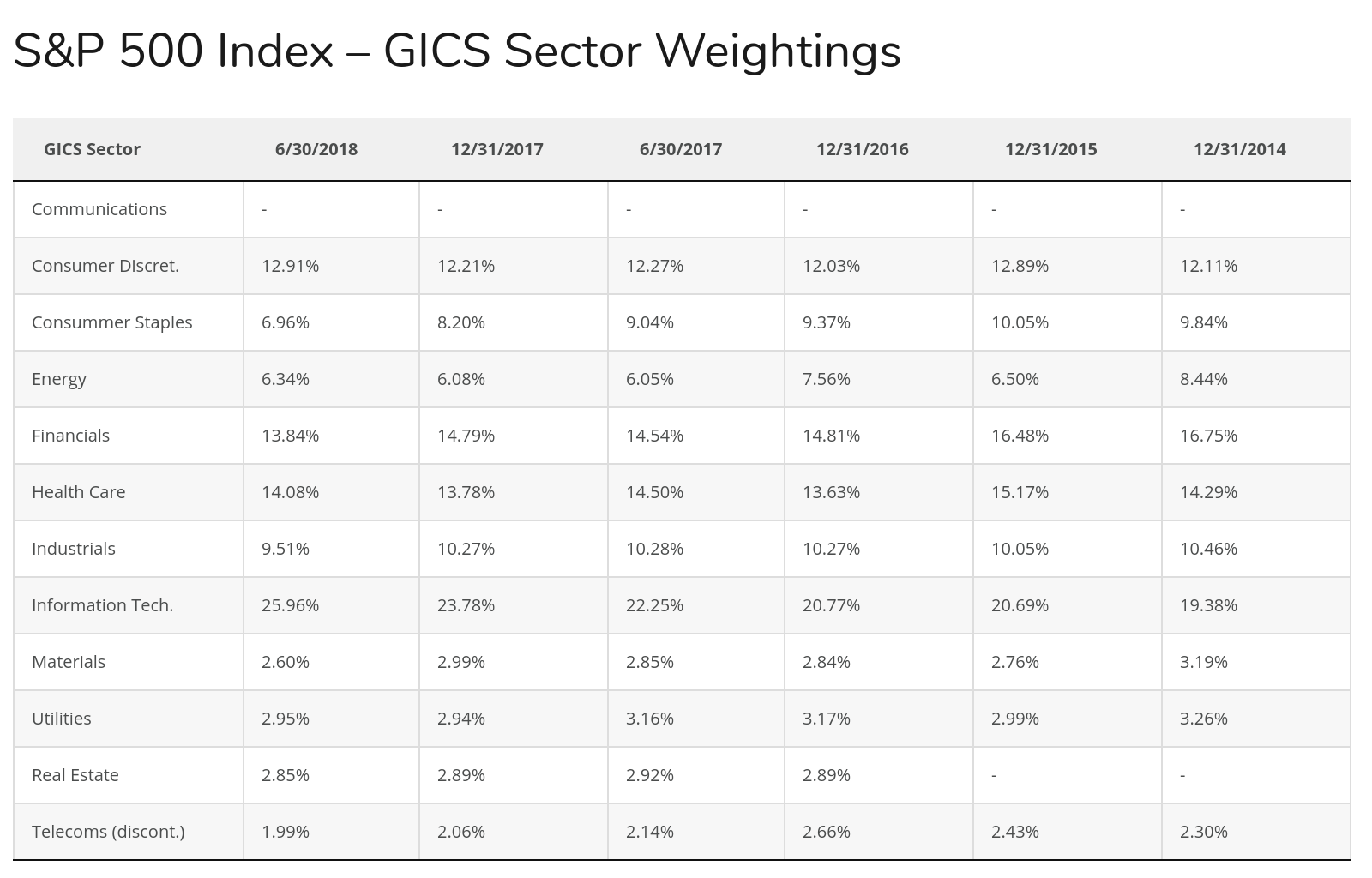

The index is considered a strong gauge of the broader market/economy due to the large volume of companies included in the index and diversification of industries among the index.Here is a diagram showing the weights of the S&P 500 as of 6/30/18 and some of the previous fiscal year ends.The source of the information from the table was Siblis Research. As you can see, this is a pretty diverse index.

How was the S&P 500 Created?