Key Takeaways

- Ethereum is back above $4,000 after breaking out of a consolidation pattern.

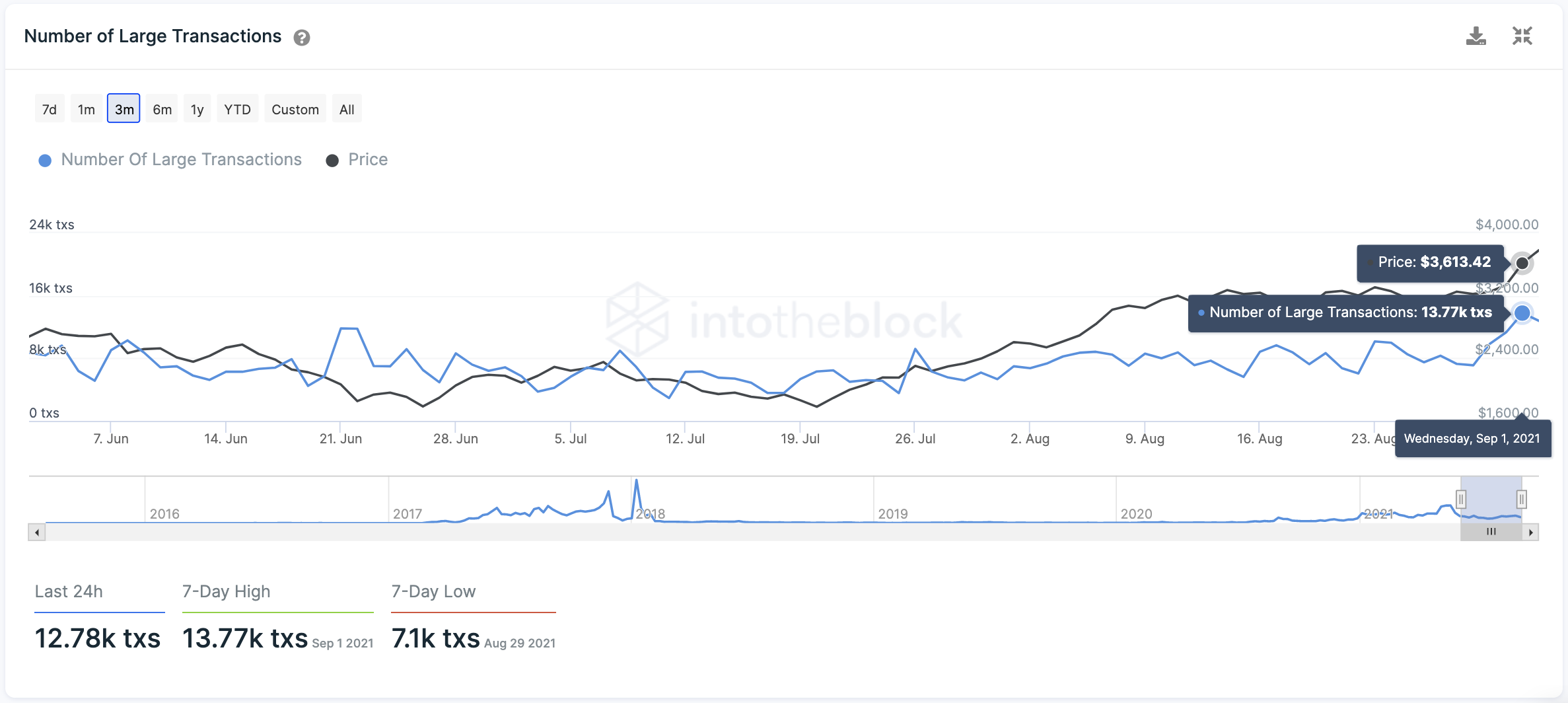

- The bullish impulse coincides with an increase in the number of large Ether transactions.

- The network activity suggests that whales may be positioning themselves for higher highs.

Ethereum is making headlines again, after surging by more than 18% within the past four days to test the psychological $4,000 level.

Ethereum Breaks $4,000

The second-largest cryptocurrency by market cap has resumed its uptrend after consolidating for more than three weeks.

Ether made a series of higher lows throughout the stagnation period, while the $3,350 resistance level prevented it from advancing further. Such market behavior led to the formation of an ascending triangle on ETH’s daily chart.

A sudden spike in the buying pressure allowed Ethereum to break out of the consolidation pattern on Aug. 31 and rise by more than 18% over the past four days to reach a target of $4,000.

Whales Are Back

The presence of whales and institutional players on the network suggests Ethereum could even target $5,000 if buying orders continue piling up.

The number of large Ether transactions with a value of $100,000 or greater continues to rise. Roughly 13,770 large transactions were recorded on Sep. 1, and this on-chain metric appears to be trending higher.

As long as Ethereum can keep its momentum and prices hold above $3,800, further gains can be expected.