Orion Engineered Carbons – Chart Of The Day

Jul 17, 2017

Jeremy Parkinson

Finance

The Chart of the Day is the break-out chart of Orion Engineered Carbons (OEC). I found the carbon black stock by using Barchart to sort today’s All Time High list first by the most frequent number of new highs in the last month, then again by technical buy signals of 80% or more. Since the Trend Spotter signaled a buy on […]

E

Immune Pharmaceuticals: Two For The Price Of One

Jul 17, 2017

Jeremy Parkinson

Finance

Immune Pharmaceuticals (Nasdaq: IMNP), a biopharmaceutical company undergoing a restructuring to split its wide-ranging, diversified portfolio into two pure play companies, has garnered much media attention in the past few days. Immune, the parent company, and its recent subsidiary, Cytovia, are gearing up for an anticipated full split with new patent filings, strategic deals for […]

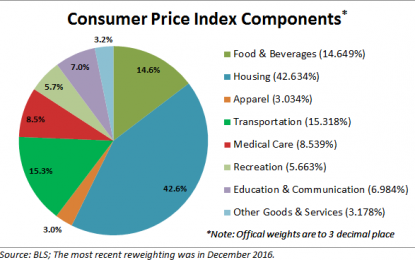

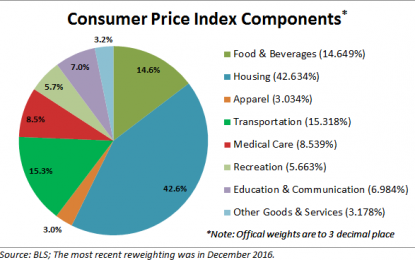

What Inflation Means To You: Inside The Consumer Price Index

Jul 17, 2017

Jeremy Parkinson

Finance

Note: The charts in this commentary have been updated to include Friday’s Consumer Price Index news release. Back in 2010, the Fed justified its aggressive monetary policy “to promote a stronger pace of economic recovery and to help ensure that inflation, over time, is at levels consistent with its mandate” (full text). In effect, the Fed has been […]

I.D. Systems Announces Closing Of Underwritten Public Offering Of Common Stock

Jul 17, 2017

Jeremy Parkinson

Finance

WOODCLIFF LAKE, N.J., July 17, 2017 (GLOBE NEWSWIRE) — I.D. Systems, Inc. (Nasdaq:IDSY) (“I.D. Systems” or the “Company”) today announced the closing of its previously announced underwritten public offering consisting of 2,608,695 shares of common stock at a price per share of $5.75. In addition, the underwriters of the public offering have exercised in full their option […]

Can Binge-Watchers Keep Up With The Market?

Jul 17, 2017

Jeremy Parkinson

Finance

Photo Credit: Global Panorama Netflix has some interesting stats to pay attention to this quarter. There is a 13% difference in Estimize and Wall Street’s EPS estimates for FQ2’17, $0.18 and $0.16 respectively. However, both platforms pretty much agree on NFLX’s revenue for this quarter; Estimize predicting $2,764M and The Street estimating $2,759M in revenue. Likewise, NFLX […]

Barron’s Curses Bitcoin

Jul 17, 2017

Jeremy Parkinson

Finance

The cover curse continues to have great strength… Of course, Barron’s isn’t alone in this wicked potency…

Billion Dollar Unicorns: Garena Files Privately In New Avatar

Jul 17, 2017

Jeremy Parkinson

Finance

Singapore-based Garena became the most valuable Billion Dollar Unicorn from South East Asia riding on the popularity of its games. It has now expanded into e-wallets and e-commerce in the South East Asian region and has filed privately for an IPO after rebranding itself as Sea. Sea’s Journey When Forrest Li heard Steve Job’s famous “Stay hungry, stay […]

4 Sell-Ranked Drug Stocks To Avoid Ahead Of Q2 Earnings

Jul 17, 2017

Jeremy Parkinson

Finance

Earnings season for the biotech and pharma sector kicks off this week with industry bellwether Johnson & Johnson (JNJ – Free Report) reporting second quarter results tomorrow before the market opens. Swiss pharma giant, Novartis (NVS – Free Report) , which was in the news recently related to a favorable FDA advisory panel recommendation for its CAR-T cell therapy, […]

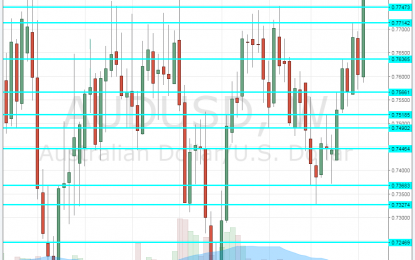

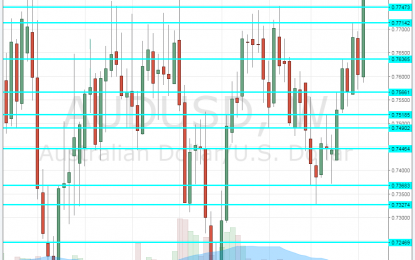

AUD/USD Creates Big Double-Top At 0.7840

Jul 17, 2017

Jeremy Parkinson

Finance

The Australian dollar has a good memory for old lines. The cycle high of 0.7840 was recorded back in April 2016. 15 months later, AUD/USD approaches this line very slowly but once it gets too close, it suddenly drops. At least for now, Aussie/USD is rejected from this resistance line and forms a double-top. Will […]

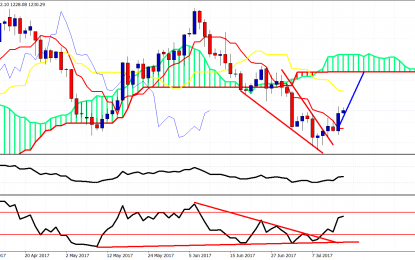

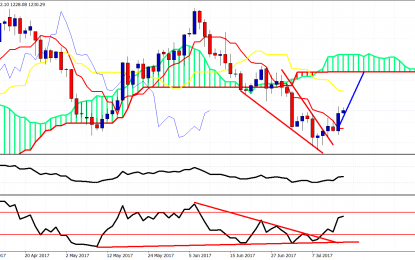

Gold, Silver And Miners Are Sizzling Hot

Jul 17, 2017

Jeremy Parkinson

Finance

Gold and Silver prices have reached important long-term buying interest areas last week and we have the first reversal signs. I remain longer-term bullish and you were notified promptly by the wedge pattern breakout and the warning signs we were given before the upside reversal. My minimum bounce target is at $1,260 but overall I believe […]