Last week when the relatively soft consumer credit data was released by the Fed, I recalled a rather humorous post in Forbes Credit Gets You a TV, Not Economic Growth which concluded ….

Maybe credit really does drive growth. Maybe excess credit really does force a boom to turn into a bust. But no one has yet come up with a really compelling, testable explanation for how that happens. And no one — except maybe Dalio — has managed to use credit levels, credit-growth levels, acceleration of the ratio of credit-to-gross domestic product, or any such measure to predict when booms and busts will happen.

So this thing that almost everyone believes about the economy is really just a conjecture. Our faith in it is probably based in part on shaky analogies and bad intuition. It might be true, but we shouldn’t regard it as obvious.

I do a rather vigorous review of consumer credit monthly because:

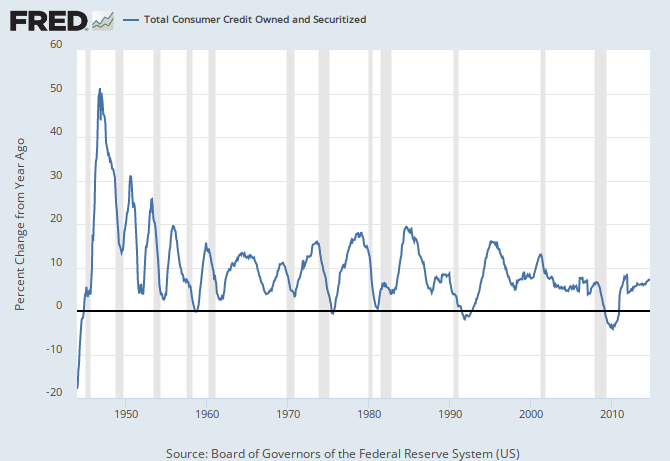

Historically, consumer credit year-over-year growth USUALLY (but not always) peaks prior to a recession, and USUALLY (but not always) is declining going into a recession. So there is a general correlation to business cycles. The problem in using this data as a tool is:

Also there is little question that consumer credit is becoming a larger and larger element in the economy – but: