As we move into December, now is the time to prime your portfolio for the coming year. Some stocks may have performed well for you in 2014, but 2015 is showing signs of above average volatility. Here are 3 stocks to drop and 3 stocks to replace them for your income portfolio.

Once we own a stock in our investment portfolios, it can be difficult to objectively analyze the company’s future prospects and ability to continue paying the dividend that is being counted on for income. As part of my research for high yield recommendations to provide to subscribers of The Dividend Hunter, I always look a company with an eye towards what could go wrong and result in a dividend reduction or even elimination. For example, on November 26, Seadrill Ltd. (NYSE: SDRL) shocked the market by suspending its dividend from what had been a steady 10% yield for the past six quarters.

Selling your shakier dividend paying stocks now may give you the double bonus of a tax write off if the shares are below you purchase value and the avoidance of a dividend cut as the market moves into a 2015 that is showing signs of above average volatility. Below we’ll review three stocks that I would not want to own going into 2015 and a couple that could provide replacement income in your portfolio.

High-Yielders to Sell

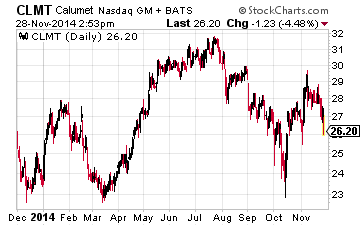

The Calumet Specialty Products Partners, LP (Nasdaq: CLMT) unit price is very close to a break even compared to where it opened for 2014. However, the unit price is 20% below its summer 2014 highs.

Calumet bills itself as a stable distribution paying master limited partnership – MLP, but about half of the company’s gross profits are derived from extremely variable refined fuels sales. For 2013 and the first half of 2014, the free cash flow generated by Calumet was significantly less than the actual distributions paid to investors (red flag!). The company had to borrow over $200 million just to cover the pay outs to investors. The 2014 third quarter was much improved over the previous 6 quarters, but CLMT is still very exposed to low profit margins derived from volatility in energy and fuel prices.