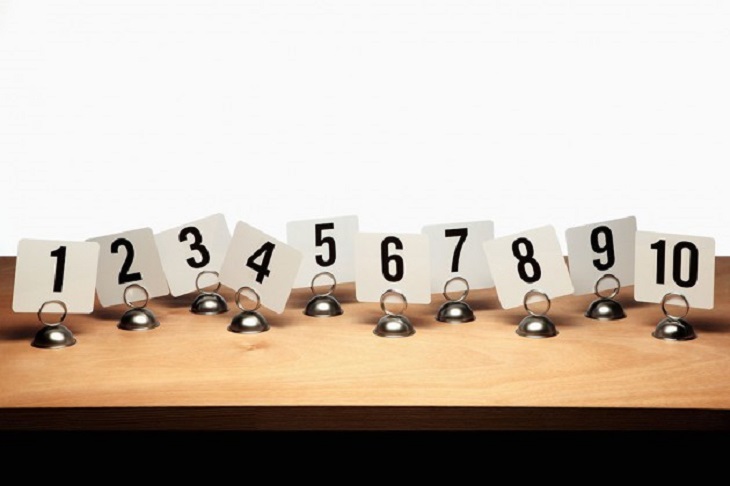

Enough with the debate over whether 2014 was a bad year (Islamic State, Ebola, Crimea) or a good year (homicide rates are falling). Time to take a look at the shiny new coin in the palms of our hands: 2015. How will it measure up? Here are 10 numbers to watch:

U.S. unemployment rate in November

U.S. unemployment rate in November

The obvious reason to care about this number in 2015? It tells us what share of the workforce can’t find jobs. The less obvious reason? It’s a key metric for the Federal Reserve, which will be deciding when to start raising interest rates. According to materials released on Dec. 17, 5 percent to 5.8 percent is the range of estimates [PDF] for the “longer run” level of unemployment by various members of the rate-setting Federal Open Market Committee. In other words, at the current jobless rate of 5.8 percent, at least one member of the FOMC thinks unemployment has already fallen to its long-run level—the one at which the economy is running as fast as it can without generating excessive inflation. The lower into the range that the jobless rate gets in the new year, the more FOMC members will decide it’s time to raise rates, taking away some of the economy’s fuel.

Yield on Greek government three-year bonds, Dec. 29

Yield on Greek government three-year bonds, Dec. 29

Greece is headed for snap elections in January, after Prime Minister Antonis Samaras failed to persuade lawmakers to support his candidate for head of state. Bondholders are worried that the opposition Syriza party will win and back out of the deal that Greece struck with foreign creditors. That explains the sharp rise in the yields they’re demanding to hold Greek bonds—from less than 4 percent as recently as September.

Beijing Real-Time Air Quality Index, Dec. 29

In December the Institute of Public & Environmental Affairs, a Beijing-based nongovernmental organization, published a report on air pollution produced by publicly listed companies operating in China. It showed that 34 of 36 listed steel companies had committed air pollution violations from August to October 2014. The good news, writes Bloomberg View columnist Adam Minter, is that “the mere existence of the data” suggests that “China, after decades of prioritizing economic growth over the environment, now seems willing to pressure and even embarrass some of its most powerful corporate citizens in order to curb pollution.”

Barrels in the U.S. stock of crude oil in the week ended Dec. 19, excluding the Strategic Petroleum Reserve

Barrels in the U.S. stock of crude oil in the week ended Dec. 19, excluding the Strategic Petroleum Reserve

While drivers focus on the pump price of gasoline, market insiders pay attention to how much crude oil is accumulating in tank farms. The logic? Stocks rise when supply exceeds demand. That’s a sign that prices need to fall even more to encourage consumption and suppress output. The 387.2 million barrels in stock on Dec. 19 was the most for that time of year since the U.S. Energy Information Administration began publishing records in 1982. That sets up the market for possibly lower prices in 2015.

Rubles to the dollar, Dec. 29

Rubles to the dollar, Dec. 29

The strength of the Russian currency is a sensitive indicator of investors’ confidence in the Russian economy. It took only 33 rubles to buy a dollar at the beginning of 2014, but the drop in the price of oil, coupled with Western sanctions against Russia over Crimea and eastern Ukraine, cut the ruble’s value in half by mid-December. Since then the currency has recovered ground and then lost some of it. No single number will be more important to Russian President Vladimir Putin in 2015 than the exchange rate of his nation’s currency.

Median U.S. annual household income in November

Median U.S. annual household income in November

Americans’ household income has been crawling back since 2011 in what Sentier Research calls “an uneven, but generally upward trend.” But it was still 2.8 percent below the level of June 2009, when the current economic recovery began, and 5.7 percent below the level of January 2000, when Sentier’s series began. The research firm adjusts its numbers for inflation and seasonal factors and measures pretax income. The median is the midpoint of all households’ incomes. Job growth and low energy prices should continue to help incomes in 2015.

U.S. military deaths in Afghanistan as of Dec. 29

U.S. military deaths in Afghanistan as of Dec. 29

The death toll [PDF] in Afghanistan from the longest war in American history should stop mounting so quickly in 2015. On Dec. 29, NATO-led forces and U.S. military personnel formally ended the 13-year war. But Americans will continue to be in harm’s way as Taliban and other militants step up attacks to overthrow the government. A little more than 10,000 American troops will be in Afghanistan in 2015, charged with training Afghan forces and conducting some counterterrorism operations.