by Constantin Gurdgiev, TrueEconomics.Blogspot.in

There is a scary, fully frightening presentation out there. Titled “The international monetary and financial system: Its Achilles heel and what to do about it” and authored by Claudio Borio of the Bank for International Settlements, it was delivered at the Institute for New Economic Thinking (INET) “2015 Annual Conference: Liberté, Égalité, Fragilité” Paris, on 8-11 April 2015.

Per Borio, the Achilles heel of the global economy is the fact that international monetary and financial system (IMFS) “amplifies weakness of domestic monetary and financial regimes” via:

The manifestations of this are:

So Borio’s view (and I agree with him 100%) is that policymakers’ “focus should be more on FIs than current account imbalances“. Problem is, European policymakers and analysts have a strong penchant for ignoring the former and focusing exclusively on the latter.

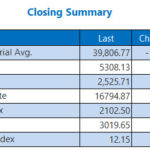

Wonder why Borio is right? Because real imbalances (actual recessions) are much shallower than financial crises. And the latter are getting worse. Here’s the US evidence: