A) Introduction

With the fears of decreased profitability arising from the Affordable Care Act now firmly gone, the market has begun to realize the great opportunity available in managed health care providers and insurers. Within this industry, Aetna Inc. (AET) has been by far the best performer. Aetna provides health insurance plans and coordinates the various health services of its customers through its broad network of physicians and hospitals. The company offers preferred provider organizations (PPOs), point-of-service plans (POSs), employer funded plans, and accountable care organizations (ACOs). Even though the company has enjoyed a strong run, we believe there is huge long term upside in holding Aetna right now. The company combines an attractive valuation with strong momentum in price and earnings.

B) Valuation Breakdown

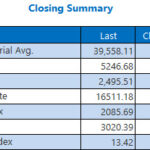

We take a quantitative approach to investing, preferring to focus our analysis on a certain set of metrics that have a strong predictive ability. This means that we only look at metrics that have an academically tested track record of predicting returns in the past. We’ll start by analyzing Aetna’s value profile. This is important to look at as “Value stocks (with low ratios of price to book value) have higher average returns than growth stocks (high price-to-book ratios)”. Aetna’s valuation profile is shown below:

(click to enlarge)

Source

Besides its mediocre dividend yield (0.93%), Aetna’s valuation looks undervalued by every measure shown above. The company generated more revenue over the last twelve months ($59.1 billion) than its market cap ($37.4), resulting in a sales yield of 157.9%. This is firmly in the top 20% percentile of the market, and higher than the industry group (120.2%), sector (19.1%), and overall market (52.9%) averages. These are by no means empty sales either; Aetna generated $2.15 billion in earnings over the last twelve months. This resulted in a 5.75% earnings yield, which is again higher than the industry group, sector, and overall market averages.