I have been touting a major top in stocks, especially in the Dow and the largest small-cap index, the Russell 2000.

With each new bubble, we reach higher highs, and then crash to lower lows. It’s such an obvious megaphone pattern that I’m not sure how anyone could miss it.

Central banks continue to stimulate us out of each downturn and crash with free money and zero interest rates. How could that not create a greater bubble and greater crash to follow… unless you really can get something for nothing?

Most economists miss this. It flies over Wall Street pundits’ heads. It’s beyond belief!

In addition to the two indices I’ve already mentioned, there’s another showing obvious signs of an impending collapse: The S&P 500.

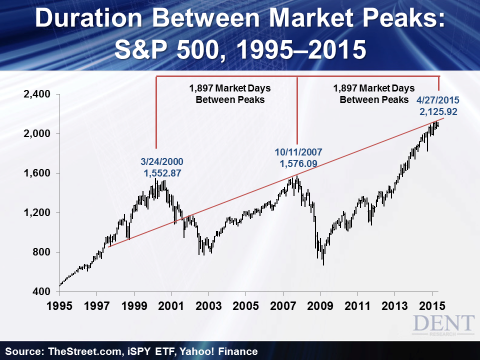

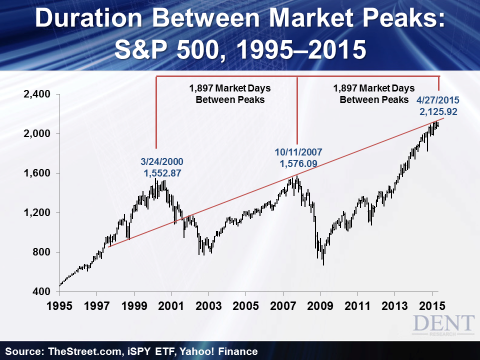

First, notice the trend line. It follows the lows in corrections in the late 1990s bubble through the tops in early 2000 and late 2007. Looks like we already hit that trend line peak on April 27 at 2,126.

But even that isn’t the most important indicator here. The tops in early 2000, late 2007, and late April 2015… were exactly 1,897 trading days apart.

That just about sent a shiver down my spine!

We’ve been in an unprecedented period since late 2008 wherein central banks around the world have stepped in and printed whatever amount of money they deemed necessary. They’re desperately trying to stop the depression and deflation meltdown that started in the second half of that year.

But there is a limit to how much you can stimulate an economy pointing down… especially one already up to debt levels twice that of the last great bubble boom that peaked in 1929 — 4 times if you include unfunded entitlements.

Just how much more can you get people and companies to spend and borrow when they already way overdid that?

The answer is, you can’t.

It’s governments that have borrowed more to offset the slowing of spending and debt in the private sector. Consumers and the way-over-leveraged financial sectors have cut back.