U.S. economic growth has slowed in recent months, but the deceleration to date remains well short of a tipping point for the business cycle, based on a broad set of published reports through April. There’s heightened concern that the economy will remain unusually vulnerable if the weakness persists in the second-quarter. As a result, the yet-to-be published numbers for May could be decisive. Meantime, the current numbers strongly suggest that April wasn’t the start of a new recession for the US. Growth may turn out to be slower than recently anticipated, but it’s not yet obvious that a sluggish pace of expansion will soon lead to a new phase of economic contraction.

Using a methodology outlined in Nowcasting The Business Cycle: A Practical Guide For Spotting Business Cycle Peaks, an aggregate of economic and financial trend behavior suggests that business-cycle risk remained low in April. The Economic Trend and Momentum indices (ETI and EMI, respectively) are still at levels that equate with expansion, albeit at a lesser rate than we’ve seen recently. But even after the soft first quarter, the current profile of published indicators through last month (12 of 14 data sets) for ETI and EMI reflect positive trends, with the exception of the corporate bond spread.

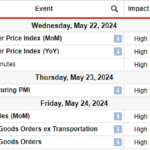

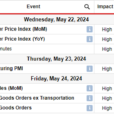

Here’s a summary of recent activity for the components in ETI and EMI:

Aggregating the data into business cycle indexes continues to reflect positive trends overall. The latest numbers for ETI and EMI indicate that both benchmarks are well above their respective danger zones: 50% for ETI and 0% for EMI. When the indexes fall below those tipping points, we’ll have clear warning signs that recession risk is elevated. Based on the latest updates for April — ETI is 88.1% and EMI is 5.6% — there’s still a comfortable margin of safety between current values and the danger zones, as shown in the chart. (See note below for ETI/EMI design rules.)