Euronav NV (EURN – Snapshot Report) is a crude tanker pure play, and is the third largest public operator of Suezmax and VLCC vessels. Currently, OPEC is producing high levels of crude, and is expected to continue this pattern over the foreseeable future. Euronav is extremely well positioned in the crude tanker market to take advantage of these increased levels of production. As long as OPEC continues to have high levels of production, demand for storage tankers will continue to remain at elevated levels. Further, due to low oil prices, demand has increased and the need for storage tankers has risen. Because of these factors, Euronav is the Zacks Bull of the Day.

This Zacks Ranked #1 (Strong Buy) together with its subsidiaries, owns, operates, and manages a fleet of vessels for the transportation and storage of crude oil and petroleum products worldwide. The company operates through two segments: Tankers; and Floating Production, Storage, and Offloading/Floating, Storage, and Offloading (FPSO/FSO). As of April 27, 2015, it owned and operated a fleet of 53 double hulled vessels, including 1 ultra large crude carrier; 2 floating, storage, and offloading (FSO) vessels; 27 very large crude carriers; and 23 suezmaxes. In addition, its ship management services also comprise financial, information technology, human resources, and legal services; project management for new building supervision, including pre- and post-contract consultancy and technical support, as well as FSO conversions; commercial management; and operational management.

According to management, the “first quarter 2015 started strongly with a good winter market which was unaffected by the usual hiatus of the Chinese new year. The lower oil price opened up a contango in January which quickly closed as the lower price stimulated prompt demand which in turn lifted the price of physical oil for immediate delivery. Whilst this also increased the price of bunker fuel nevertheless owners benefitted from the increased demand for shipment.” This demand enabled Euronav to easily beat the Zacks Consensus Earnings Estimate, and post a positive earnings surprise of +22.73% in Q1.

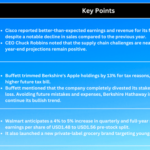

Increasing Estimates

The graph below shows Euronav’s Price and Earnings Consensus. As you can see expectations continue to rise for this tanker company.