Sellers in the S&P made it five days of downside in a row. On this last day it closed near the day’s lows, but also on its 200-day MA. If there was reason for a bounce, then tomorrow could be the day. Technicals are all net negative.

The Dow took the selling harder. It undercut the July swing low having earlier lost its 200-day MA. Next up is the February swing low.

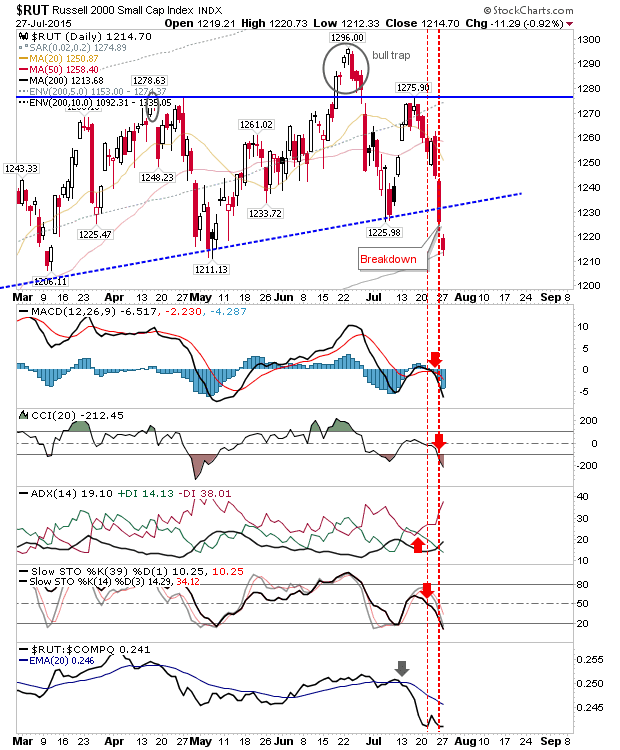

Small Caps finished at its 200-day MA, after it lost trendline support on Friday. Value players may get a bite of the cherry tomorrow as the index makes it first test of the 200-day MA since February.

The Nasdaq remains caught inside the range. It suffered a fairly clean slice of both 20-day and 50-day MAs, but the nearest support appears to be the July swing low, then the 200-day MA. If markets rally tomorrow, then look for a push to close today’s breakdown gap.

Tomorrow looks to be set nicely for bulls, even if the broader picture appears to favor an intermediate term correction. Indices trading at 200-day MAs are likely to offer the best opportunity, with the Russell 2000 perhaps the best of all.