When we talk about the euro, we usually don’t consider the United Kingdom as a dominant presence in the discussion. After all, despite being a member of the Eurozone group, London has opted to keep the Pound Sterling as her local currency. When it came to the latest ongoing Greek crisis, nary a word was heard from voices at the City of London financial center.

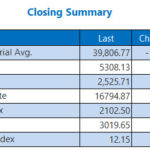

Looks are deceiving however. London’s dominance of the $5.3 trillion-a-day foreign exchange market exists in force and surprisingly the financial center sees more activity in buying and selling euros than the whole 19 member Eurozone together and more dollars than the U.S.

Brexit Possible

All this may change. The U.K. is now under pressure from many of its leaders to leave the EU, a move that would drop its position as the king of foreign exchange which it has dominated for more than two decades and hit at the heart of post-imperial Britain’s position in Europe.

Jim Rogers, co-founder together with George Soros of the Quantum Fund in 1973 believes that “If the UK left the European Union, London’s dominance of foreign exchange including euro trading would gradually decline and then end as the flows moved to Asia and other European centers.”

London has the deepest pockets in the time zone between Asia and the United States and reigns as the ruler of global business in terms of luxury property, education, property rights and cultural renewal that is unmatched anywhere else. But a Brexit from the euro would move foreign trading to the continent and beyond and leave London to fend for itself.

Although Britain had joined the European Economic Community in 1973, it chose to stay out of the euro when the currency was put into place in January 1991. There are several reasons why it elected to do so.

At the time, the British government was worried about relinquishing control of its own interest rate policy which would have been necessary under a euro system. In addition, London would have been forced to meet the “euro convergence criteria” before adopting the euro, which included maintaining a debt-to-GDP ratio that limited British fiscal policy.