Stocks may have made a gain last week, but it was a hard-fought victory, and may have exposed just how vulnerable the market is right now. And, this week’s trading will start out where last week’s left off… within easy reach of some critical support levels, and in the shadow of still-waning momentum.

We’ll discuss it all – and show you – below, right after a quick rundown of last week’s and this week’s major economic announcements.

Economic Data

Last week was a rather busy one in terms of economic data, though not a great deal of it was hard-hitting news. In fact, the only items of real interest were July’s retail sales levels and last month’s industrial productivity data from the Federal Reserve.

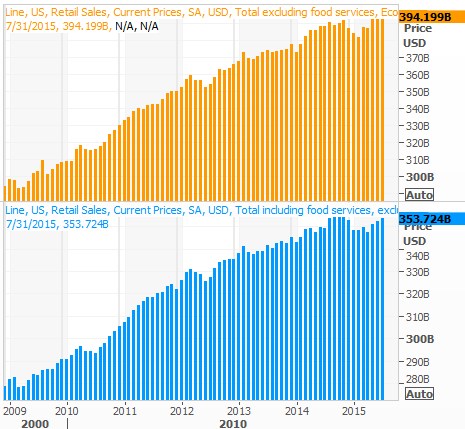

On the consumer spending front, compared to June’s levels, retail sales grew 0.6% last month with cars, and were up 0.4% without factoring in auto sales. Overall retail sales were up 1.6% compared to July of 2014, and they grew 1.3% year-over-year on an ex-auto basis.

Retail Sales Chart

Source: Thomas Reuters

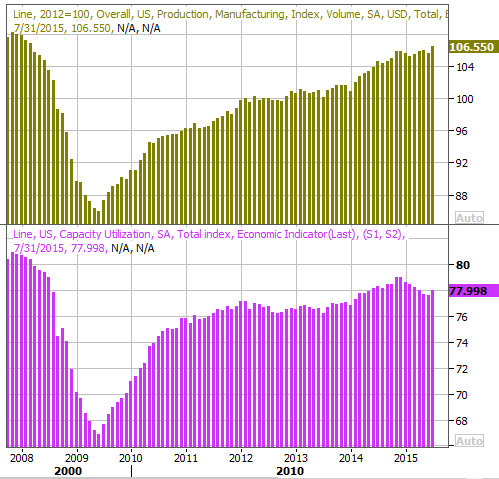

As for how busy our factories were last month, there’s a clear improvement recently following the lull during the first half of the year. We’re now using 78% of our output capacity, and factory production grew 0.6% in July.

Capacity Utilization & Industrial Production Chart

Source: Thomas Reuters

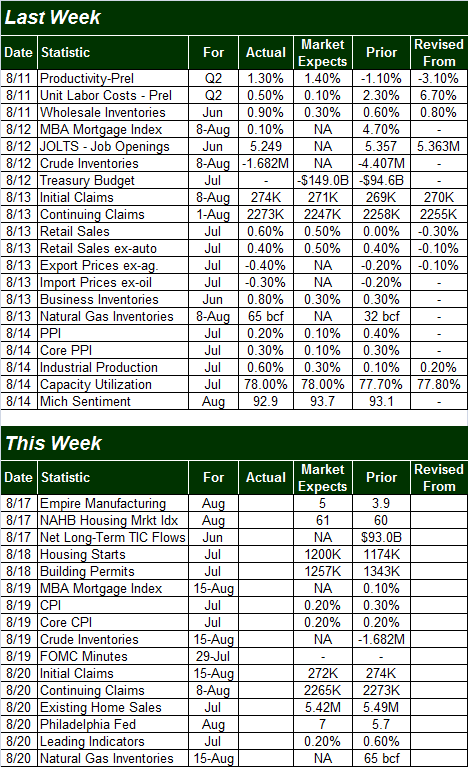

Everything else is on the following grid:

Economic Calendar

Source: Briefing.com

This week is going to be similarly busy, though the highlight is likely to be Wednesday’s release of the minutes from the last FOMC meeting. Once again the market will seek to derive some meaning in the nuanced changes of the language the Fed uses to describe its plans on the next rate hike. The recent trend has vaguely pointed to a rate hike sooner than later, and little has changed in the meantime that would force Janet Yellen to lengthen that time frame again.