Over the past several years, one of the biggest critics of the Fed’s ruinous monetary policy has been billionaire investor Stanley Druckenmiller, who in 2010 announced he would be shutting down his legendary Duquesne Capital Management, and convert it to a family office. Yet, despite his constant drumbeat of warnings that the period of ZIRP/QE/NIPR will end in tears, he had yet to put money where his mouth was (aside for a brief period in mid-2012 when we bought a lot of GLD calls, only to unwind the almost instantly).

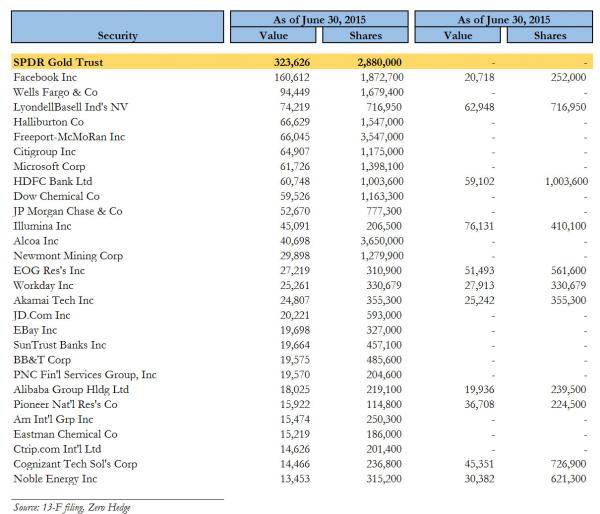

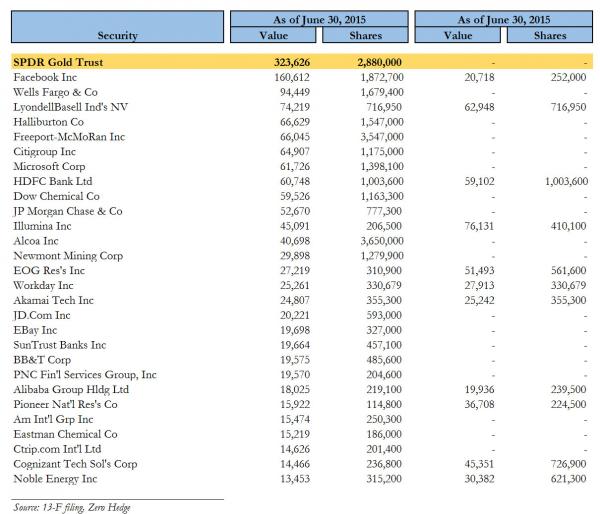

This ended on June 30, when following Friday’s filing by the Duquesne Family Office, we learned that as of the end of Q2, the largest position for Stanley Druckenmiller was none other than gold, following the purchase of 2.9 million shares of the GLD ETF (GLD) shares. In other words, as of this moment, gold amount to over 20% of Druckenmiller’s total holdings.

In a world in which starved for ideas alpha-chasers do anything and everything that billionaires report they did a month and a half ago, we wonder if this marks the end of the relentless liquidation in the GLD ETF, which recently hit a multi-year low, as a result driving the price of paper gold to multi-year lows even as physical demand has approached record levels.

So with Druckenmiller now back and strapped in for the ride, we wonder which other prominent investor will promptly follow?

h/t Shane Obata