The general perception that the countries in the Middle East are flush with cash and are deliberately keeping oil down to harm Iran when it begins to sell is rather childish. Budgets have risen and become bloated. Gasoline prices even rose in the United Arab Emirates (UAE). Dubai stocks fell to the lowest in more than two months, leading declines across most markets in the Middle East. The rout unfolded after the UAE’s biggest-listed property construction company reported a third straight quarterly loss. It appears that our real estate model calling for the more general high on a global scale in 2015 appears to be correct at this time from Europe and the USA, off to Asia and the Middle East.

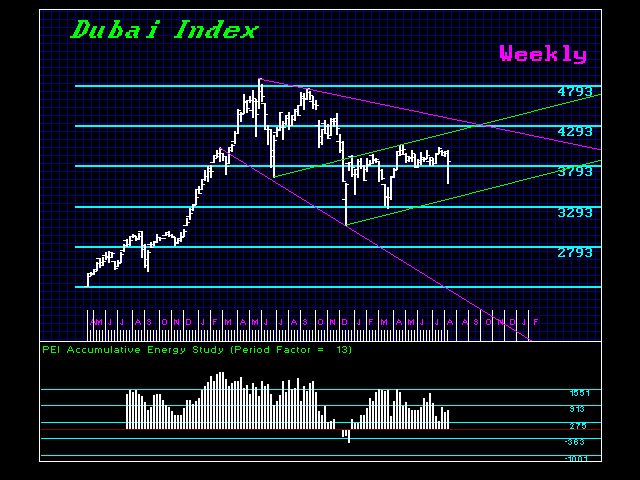

The DFM General Index slid 1.2% to 3,937.34 at noon local time, the lowest since June 2. Arabtec Holding Co. slumped 4.9% to 2.13 dirhams, bringing the decline this year to 24% to the lowest since March.

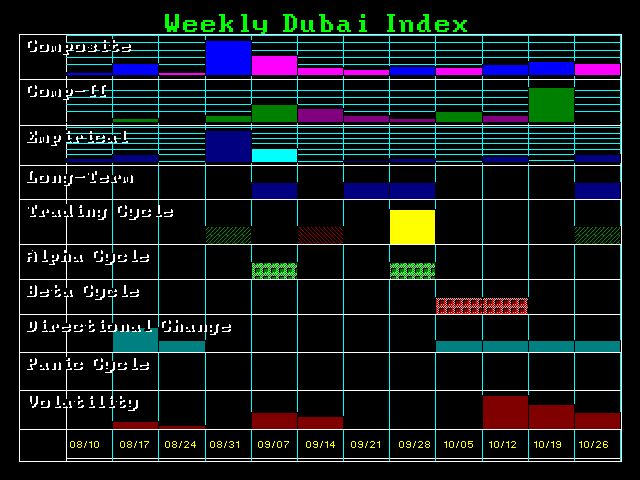

Our weekly bearish point lies at the 359530 level followed by the major at 312727. The critical level is defined by the monthly bearish point at 338810. A monthly closing beneath this level on a monthly basis will warn that the 2014 high will remain intact and a decline is likely into 2016. This week is a directional change so caution is advised.