Is now the time for dividend investing?

While the dividend investing style is almost always overlooked, it still has a place in many portfolios even though many consider it a ‘boring’ way to growth wealth in a portfolio. Sure investors often prefer growth securities that are increasing earnings or revenues, or securities with value metrics such as low PEs and modest debt levels, but now could actually be an interesting time for dividend investing.

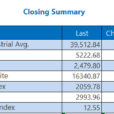

That is because markets are still near all time highs, but volatility is definitely returning. High dividend stocks can often be less volatile than their low-yielding or non-dividend paying counterparts and this could be vital if volatility levels run higher from here.

But even if you aren’t concerned with the state of the market right now, dividend investing can be great for other reasons too. The idea of reinvesting dividends– where investors use to dividend payments to buy more shares– can be a great long term strategy. After all, this approach can really add up over time thanks to the impact of compounding and it is a factor that is often glossed-over by investors these days.

Where to Find the Best Dividend Stocks Now?

Easily one of the biggest problems with dividend stocks is finding the right ones. There are plenty of stocks that pay dividends and you certainly can’t just pick whichever ones have the highest yields. A better way to find top dividend stocks is to look at ones that have market-beating yields, and are seeing rising earnings estimates too.

Securities with this combo may be the perfect mix for dividend investors while still providing the potential for outperformance. So definitely consider any of the names highlighted below if you are looking for excellent income stocks in this uncertain environment:

Cincinnati Financial (CINF – Analyst Report)

If you are looking for a safer choice in the dividend world right now then CINF might be a great pick. The company operates in the relatively safe property and casualty segment of the insurance world which is currently a top 25% ranked industry. Plus, insurance companies are often known for their dividends as CINF has a nearly 3% payout.