We will be the first to admit that in the current centrally-planned world, where nothing but the words and deeds of central bankers matter, fundamentals, seasonals, technicals and charts are a laughable anachronism from days gone by when the market – as traded by humans and not vacuum tubes with laser beams – could drop 10% without the Federal Reserve collapsing into a panicked mess.

However, there are those who still believe that what used to work in the past still does, and trade according to the patterns observed in the Trader’s Almanac.

While that is clearly folly (as it does not account for what any given central banker had for dinner the night before – a key variable in this “New Normal”, ridiculous age) for their benefit we point out something curious about the month of April, traditionally the strongest month of the year… except during presidential election years, when it slides from the best month to the second worst.

Additionally, as Evercore ISI technician Rich Ross points out, there are several other patterns which suggest that, in the absence of central bankers, one would be advised to trade, and tread, carefully in the coming months.

This is what Ross writes in a note explaining why he maintains his defensive, bearish stance:

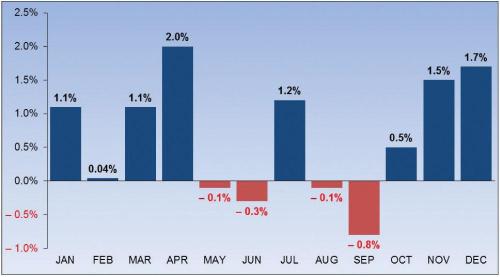

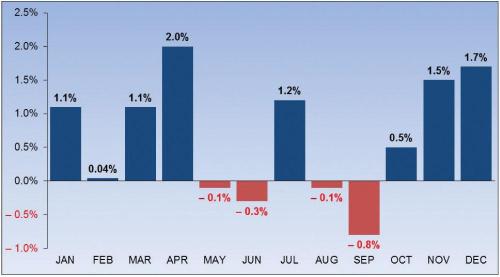

We transition from the best 6 month stretch for the S&P since 1950 into the worst 6 month stretch which commences in May. Moreover, while April has been the best month for the Dow over the past 65 years (+2.0%)…

… during Presidential Election Year’s April falls from a 1 seed to an 11 seed with an average loss of .9% according to the Stock Trader’s Almanac (Jeffrey Hirsch).

Hirsch also notes that “prior to President Obama, there have been six previous presidents that served an eighth year in office…. and in those eighth years the DJIA and S&P have suffered average declines of -13.9% and -10.9% respectively (Only 1988 was positive).”

… our defensive game plan is dictated not only by seasonal trends and presidential patterns, but by the presence of overhead resistance and long term moving averages which loom ominously overhead countertrend rallies within the context of structural downtrends. Defense wins championships, and right now it’s “cheap” on the charts.