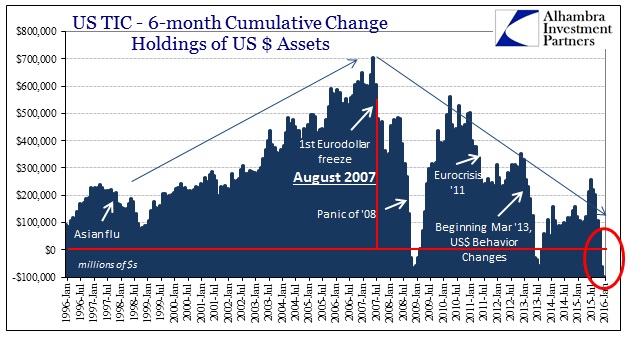

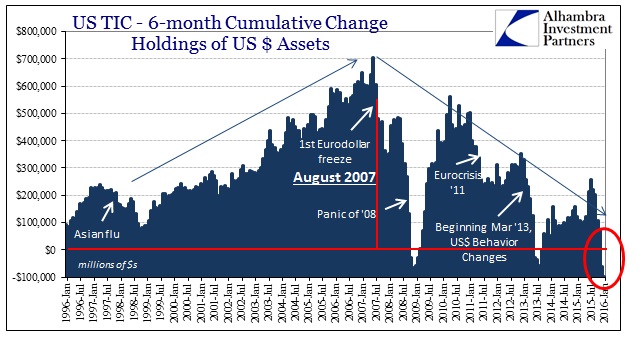

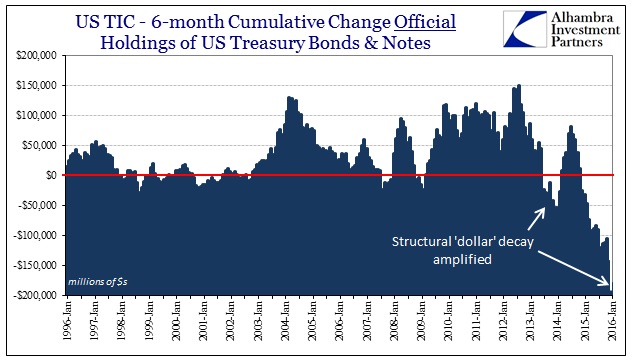

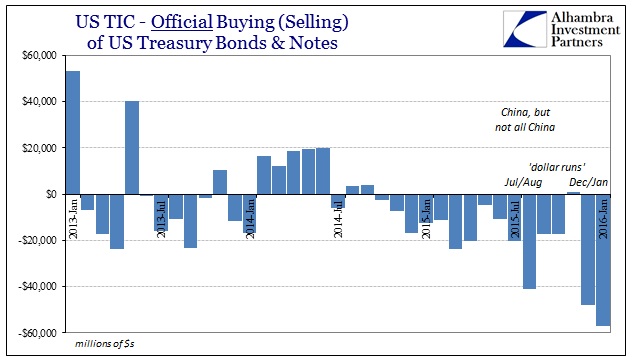

The “first” part of the TIC data update for January was relatively straightforward, especially since the scale of the net transaction adjustments in both December and January really did match what happened in January (crossing into February). The Treasury Department’s estimate for foreign holdings of US dollar assets were nothing short of remarkable in all the ways that were expected (unless, of course, you are fully committed to “the narrative” and thus find it increasingly difficult to suggest how any of this is really nothing to be concerned about). As noted earlier, the net “selling” of dollar assets, primarily treasuries, was intense owing to the involvement of the “official” sector. The second part is trying to figure out who or where it was, as there is a bit of discrepancy especially for January.

Since last July, encompassing both liquidations of what appear to me as a single “dollar run”, the scale of “dollar” funding issues is almost unprecedented. In terms of just foreign central banks, it was.

That does not mean all was well at the private end; far from it. In fact, the very scale of central bank “dollar” intervention can only imply that private “dollar” markets were a total and unequivocal mess, which is the predicate cause of the liquidations of especially January. That means, as per usual, central banks attempted to address the shortfall but were unable to work more than the contours (if that). Given that these TIC estimates show more than $100 billion in UST “selling” in December and January cumulatively and liquidations occurred anyway, we can reasonably assume that the funding gap was just enormous.

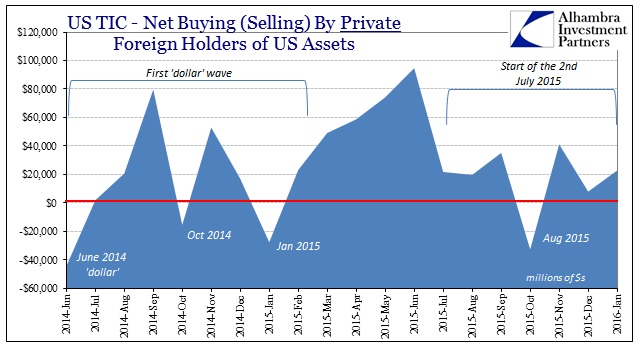

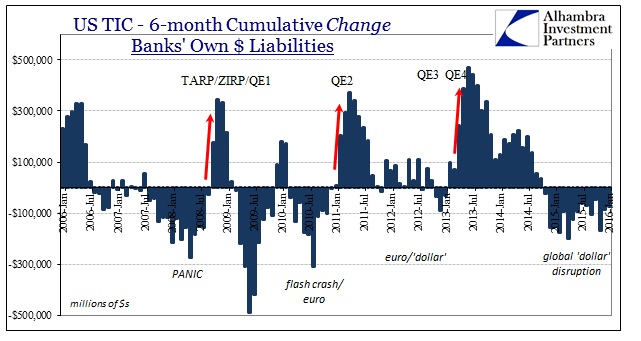

It might be at this point where it becomes confusing, as private “dollar” markets are far more than what is presented in TIC; whereas the emergency measures central banks have been taking (during this eurdollar decay period) primarily result here in “selling UST’s.” In the two charts immediately above, the private holdings of US$ assets have been rising in the past few months despite the return of liquidations. However, reported bank liabilities (“dollars”) have not, at least on a cumulative basis (there are quarterly flows and window dressings to account in this estimation; by and large, however, banks are continuously shrinking their reported “dollar” liabilities dating back, unsurprisingly, to the middle of 2014).