Back in January 2015, when we looked at the utterly disconnected fundamentals of the energy sector, we were stunned to note that the forward 12-month P/E for the Energy sector has risen above 22.4, the first time it had done so since April 8, 2002. On that date, the closing price of the Energy sector was 225.15 and the forward 12-month EPS estimate was $10.05.

Our amazement was contained in the following summary: “using the S&P Energy Sector Index data, the sector’s forward multiple is now an absolutely ridiculous, mindblowing 23x.”

This was 14 months ago. Where do we stand now?

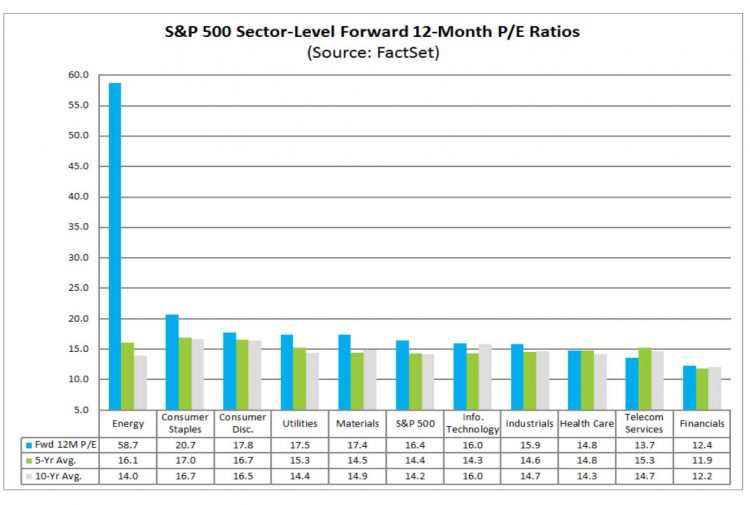

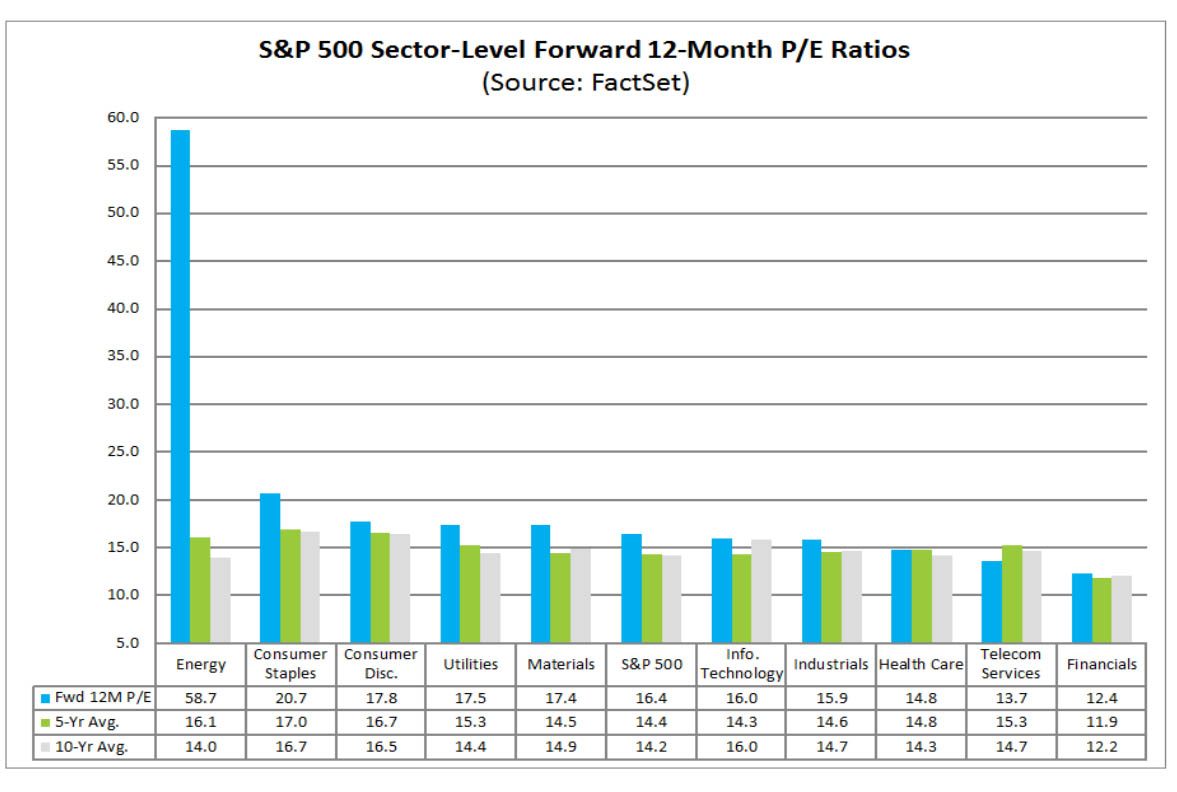

The snapshot answer comes courtesy of the latest Factset weekly earnings insight, according to which as of this moment, the forward P/E of the Energy sector is no longer “an absolutely ridiculous and mindblowing 23x“…. it is, in fact, more than double that at 58.7x, which also happens to be more than four times higher than the 15 year average.

There is no longer a word to describe the lunacy where the forward P/E multiple was literally “off the chart” until the Y-axis was doubled.

Where it gets even more surreal is when looking at the forward energy sector P/E (as defined by Bloomberg) charted over time. Yes, we laughed long and hard.

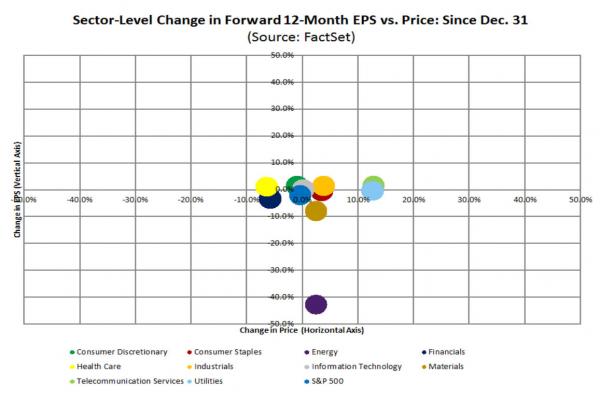

What is beyond strange is that while forward earnings have imploded in just the past three months, prices of energy companies have actually gone up as the next Factset chart shows! In other words, the market’s discounting mechanism is not onlyl broke but is now going in reverse, where the worse the projected earnings, the better for stock prices.

However, this type of disconnect – especially when it is as glaring as this – never lasts.

In that vein, one year ago, when oil had first crashed hard and when the S&P energy sector was trading at 550, we calculated that “Either Oil Soars Back To $88, Or Energy Stocks Have To Tumble By Over 40%”Energy stocks indeed tumbled, and at one point the drop was nearly 40% as predicted, but have since jumped higher on more artificial central bank manipulation of prices.