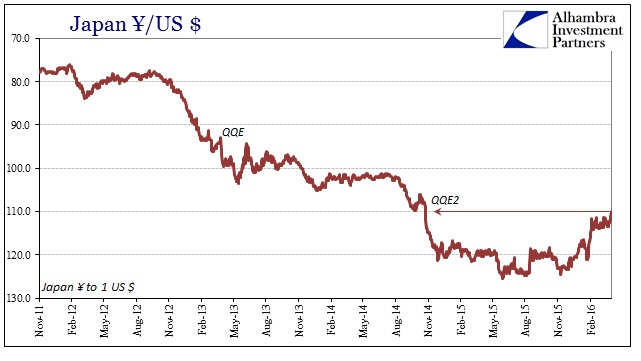

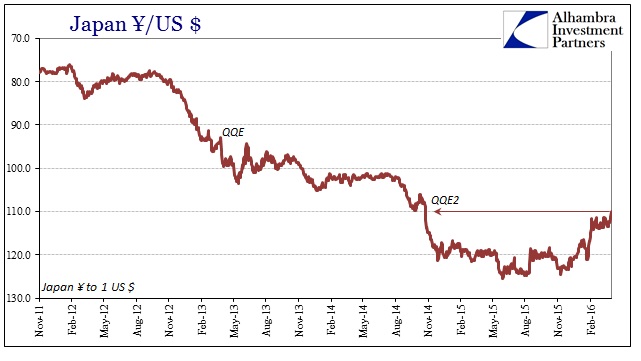

A few weeks back, on March 18, the Japanese government bond market was hit with a “buying panic” of some noteworthy proportion. Yields all across the curve dropped, which takes some doing since yields were already at that point mostly negative. Common sense forces any sane person to wonder if sanity itself remains relevant to global finance:

That raises the question as to who in their right mind is buying 10-year bonds at -10 bps? And why are they continuing to do so?…

The answer is the huge discount to “borrow yen”, meaning cross currency basis swaps. The negative premium was again at a record high in this trading, which means that investors only need a safe haven to park their “borrowed yen” while they pocket a huge spread on the swap. Who is making out in all this? Anyone with spare “dollars.”

This is one of the primary problems for the uninitiated to delve deeper into the arena of wholesale global finance, and thus question what the real global reserve currency actually is and does. There is a mishmash of terminology that depends in part on tradition and history no longer really applicable. You see it all the time, as some central bank like the PBOC will be reported as “buying yuan” or “selling dollars”, where those terms are technically correct but functionally distinct.

In terms of yen basis swaps, those looking to “borrow yen” aren’t really doing so as their primary purpose but really as the last leg in an arbitrage trade in their favor. They own something, or at least show the right sort of positive number in systemically acceptable fashion, that is in great demand and there are only so many ways to “cash in” (to utilize another ill-suited phrase to this behavior).

There was a “buying panic” in JGB’s that day because basis swaps were falling to an even greater record low spread, meaning absolutely stunning profit potential for anyone with not dollars but “dollars.” There is an ongoing and increasingly desperate shortage that commands just the kind of premium that could fund hedge fund outperformance (or some bank desks’, if they actually had some spare risk budget, which they don’t, clearly, as that is the whole ballgame here) for 10 years. That is why anyone able to post those “dollars” would be interested in a negative yielding 10-year JGB. They are not borrowing yen but accepting it as the standard of exchange in this cross-currency delivery; and then finding the relatively best place to park it while they collect the huge premium on their “dollars.”

I don’t believe it coincidence, either, that all that occurred in that week since it looks increasingly like the rebound after February 11 at least paused, then if not potentially beginning the process of once more reversing. There are any number of indications that suggest as much already (subscription required), not the least of which is the upcoming three month anniversary of January 9 and the PBOC’s return to pegging CNY. In undertaking that operation, continuously, it seems, the Chinese central bank is not “buying yuan” and “selling dollars” but writing forward cover so that Chinese banks might increase their own “dollar short” (to use yet another confusing term) on its behalf.