Economic Reports Scorecard

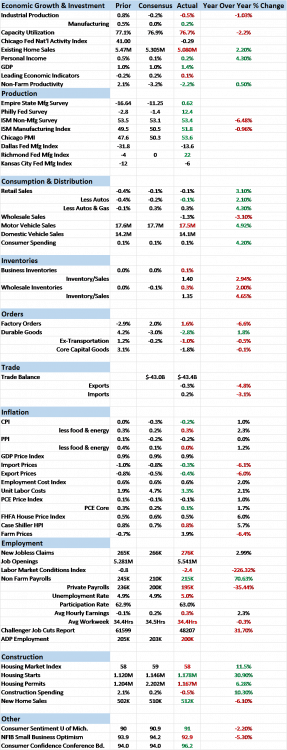

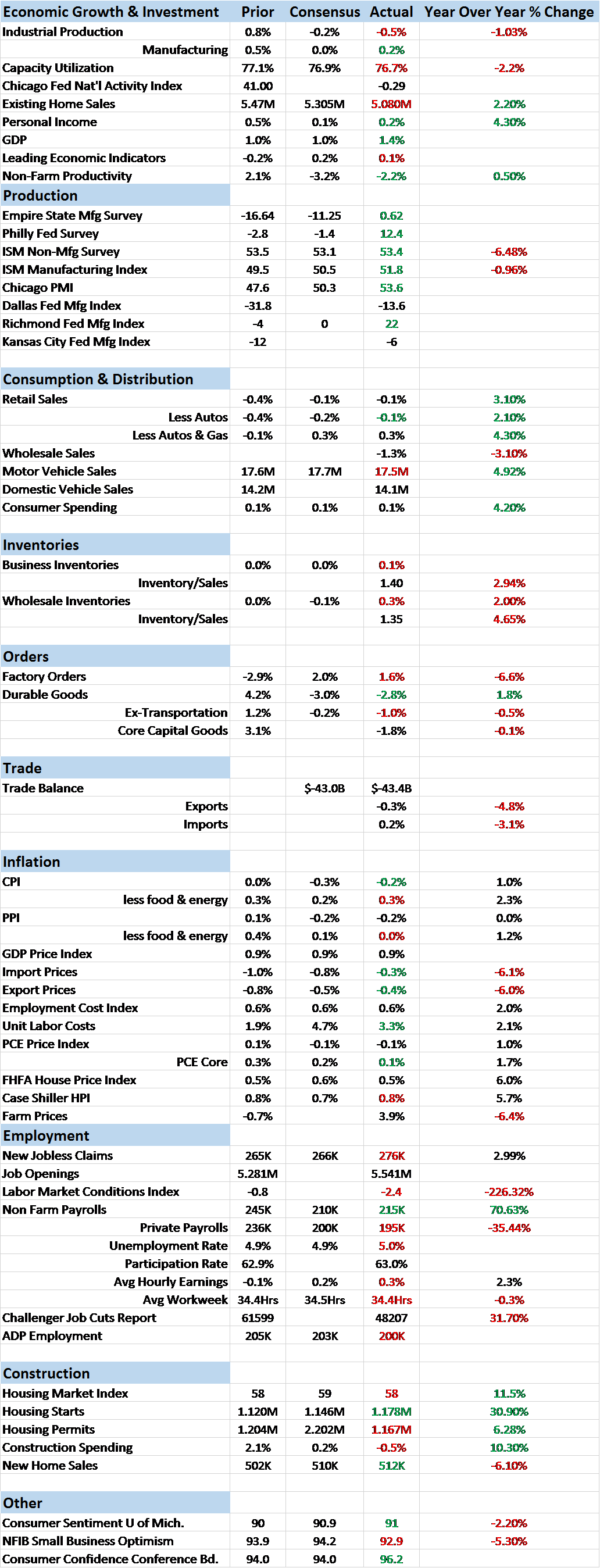

The economic reports since the last update present a dichotomy. While there has been an improvement in the surprises – more better than expected reports – the overall tone of the reports has been fairly negative. Part of the explanation for that is the plethora of regional Fed reports over the last two weeks, almost all of which showed significant improvement. That contrasts somewhat with the real manufacturing data we received. The Durable Goods report in particular was quite weak, down 2.8% – and better than the -3% expectation. Ex-transportation orders were down 1% and core capital goods orders were down 1.8% (but down just 0.1% year over year).

The personal income and spending report was also disappointing. Income was soft, up just 0.2% with the wages and salaries portion turning negative. The spending portion was also a disappointment but more for the revision than the current month. Last month’s 0.5% rise had been cited by the bulls as evidence the economy was doing just fine but almost all of it was revised away with January and February both now printing at 0.1% gains.

In real estate both the existing and new home sales figures were consistent with the flattening trend we’ve been seeing there. Real estate appears to be suffering from price shock to some degree as prices are rising fairly rapidly, up around 6% year over year. With rents also rising rapidly, shelter is one area where deflation doesn’t appear to be a concern. Construction spending was a bit less than expected but is still rising at double digit rates year over year.

Besides the aforementioned regional Fed surveys there were some other positives. The ISM manufacturing report improved just as the Fed surveys did. 4th quarter GDP was revised a bit higher but at 1.4% is still a pretty meager portion of growth. Exports and imports of goods were both reported higher by 2.0% and 1.6% respectively. Jobless claims continue to track below 300K and consumer confidence and sentiment both ticked higher. And of course, payrolls continued to improve, up 215K in March. The participation rate even ticked up a bit keeping the unemployment rate from improving despite the jobs added.