The DAX 30 (FXCM: GER30) is little changed at the time of writing. The biggest drag to the index is from car-makers, who are part of the Consumer Discretionary Sector which is currently lower by 1.27% in today’s session. The Health Care Sector, up by 0.74%, is the current winner.

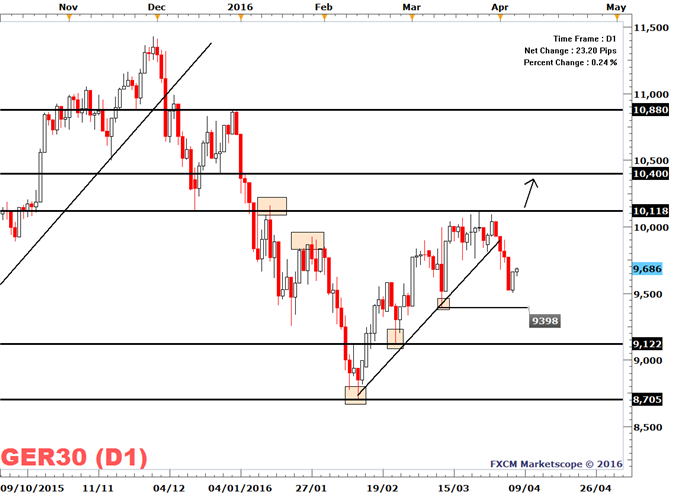

The DAX 30 index itself has been trading with a slight bearish bias over the last few days as the current weekly high of 9906 is lower than the March high of 10,118. The lower highs and lower lows make the trend short-term bearish.

However, the selling has stalled near the March 10 low of 9398, which was also the ECB rate meeting low. The next support level beyond the March 10 low of 9398 is the February 24 low of 9122.

Factors cited to support global stocks, are in general both the higher crude oil prices and yesterday’s dovish Fed rate meeting minutes. In regards to the latter, the Fed has said that the domestic economy has developed in line with their earlier expectations. Employment and wage growth were cited as reasons for the Fed to move forward with the normalization of rates, while Net exports and weak global growth were said to pose a risk to the U.S. economic outlook. Some of the Fed members have said that they are ready to hike rates in April, while others have been less enthusiastic.

The effect of the dovish statement is that U.S. short-term rates, such as the 2-year-swap, remain stable around 0.837% from trading around 1.20% in December. The lower interest rates are said to support stock markets.

The ECB Rate meeting minutes are to be published today along with the latest U.S. Jobless Claims figures. This evening, the Fed’s Yellen is set to speak in New York, along with Greenspan, Bernanke, and Volcker.

DAX 30 | FXCM: GER30

Created with Marketscope/Trading Station II; prepared by Alejandro Zambrano