After reporting FQ4 earnings Friday BlackBerry BBRY is slumping. The company achieved GAAP revenue of $464 million and a per share loss of $0.45. Revenue was down 30% Y/Y and off 15% sequentially; revenue was over $97 million lower than analysts expected.

In FQ3 BlackBerry reported a sequential increase in revenue; I expected the company to build upon that momentum which makes this quarter’s results a difficult pill to swallow.

Typically, BlackBerry’s financial statements provide segment revenue on a GAAP basis. This quarter management reneged to provide the information and preferred to talk up non-GAAP revenue, which I found rather annoying. The difference between total GAAP ($464 million) revenue and non-GAAP ($487 million) revenue was a purchase accounting write-down of deferred revenue associated with recent acquisitions. It probably impacted the software and services segment. Below is my take on the quarter:

Software And Services Is The Future

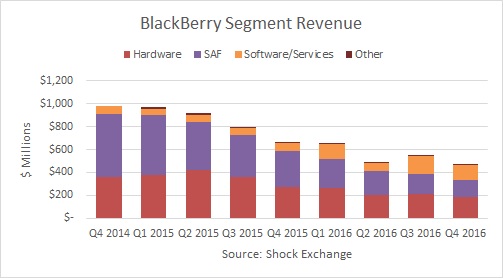

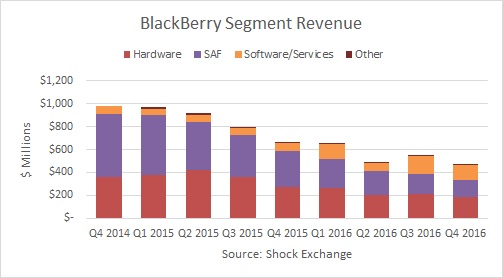

The story for BlackBerry over the past several quarters has been to find a way to offset SAF run-off. SAF was off 17% sequentially, consistent with historical declines. Last quarter BlackBerry was able to offset that diminution with revenue from software and services and hardware. That wasn’t the case this quarter. On a GAAP basis I estimated software and services was off about 14% sequentially. For FY16 the company had $497 million of revenue, on par with its $500 million revenue bogey. This is important as it demonstrates management’s ability meet realistic goals, and adds to its credibility.

The company expects to grow the segment by double-digits in 2017 and expects revenue growth to offset the decline in SAF. That’s a tall order; it’s also convenient given the lack of visibility in hardware revenue. Management intimated that Good Technology is fully-integrated and the company is delivering BlackBerry level support to Good customers. The bull case at this point is to buy BBRY based on software and services, and any contribution for hardware is gravy.