Unprecedented Transparency

Unprecedented transparency into offshore tax-haven activities have a few ramifications beyond the obvious money laundering or semi-legal funding of holdings (if disclosed to tax authorities, at least as relates to US law). One might be the global expose of troves concealing funds (that makes popular news; like the FOP’s (Friends of Putin) often accumulated by corrupt politicians or merely oligarchs and others engaging in tax evasion, or in some cases (like Ukraine’s President, for instance, who claims the funds of his chocolate business were put offshore for safety during the fear of war; and some of that makes sense).

What comes out of this goes back to a decade ago when the USA demanded an access to ‘secret’ bank accounts, and the continuing efforts to repatriate taxes or funds ‘parked’ outside domestic jurisdiction. The US law change is perhaps part of why the majority of cases are of foreign origin. And of course (as I mentioned just recently, coincidentally) the unusual mystery (for years) of LLC’s or similar entities buying property in New York and particularly South Beach.

Overpriced real estate and for that matter the art world started to fade (contrary to media highlighting the individual high-priced sales) awhile back, particularly in the wake of the collapse of Russia’s Ruble and certain Latin American currency exchange rates. This past weekend AuctionAmerica held a classic car auction in Fort Lauderdale, and a majority of the vehicles didn’t come close to the ‘reserve’ prices held; thus didn’t sell (including everything from classic Corvettes, to many choice Ferrari’s, to an almost new BMW I-8).

Rather than relating to the similarly-pricey US stock market (which even Trump opined on today as dangerous; although the opinion that might matter more was that of Stanley Drukenmiller again discussing this as unprecedented and risky), I think the implications of the ‘Panama Papers’ are stronger than most recognize.

This revelation (researched for about a year by several journalists) rekindles the very platform of Bernie Sanders (about corruption and offshore domiciles on top of it; which again may not be illegal, but the alliteration is a bit disheveling to the candidates believing there’s not much needing reform); and Donald Trump, who basically says the same thing (you’ll recall the issues are not that distinct; while the solution of resolutions are quite a different story). Regardless this focuses at least more attention on repatriation of funds to the U.S. (Microsoft and Apple of course the most prominent keeping capital offshore; the former mostly Bermuda; in the latter’s case it’s Ireland).

What this suggests is a continuing loss of faith in the way things are structured; and it’s hitting the day before Wisconsin’s Primary. It also emphasizes how truly ticked the American people are (and perhaps Europeans too) at the avoidance of taxes ‘as if a sport’ by the super-affluent. I contend this impacts spending (the high-end real estate market is about a third of total Miami area spending) and is going to contribute even to the modern-version of the ‘post-Miami-Vice’ cocaine cowboy era; when all the financiers and manipulators retreated rapidly from the conspicuous consumption of the era; as bling quickly was toned-down. Now it’s up again, like the spending in great restaurants and art galleries. Too soon to be really specific, but this smacks of part of the ‘populist’ shift that’s underway.

Bottom-line: no need to add much to the thorough weekend discussion of basic financial, geopolitical, and technical conditions. If you didn’t review that report, at least a couple members appreciated the review (thanks!); so I suggest checking it out (as nothing has changed; other than Goldman and others dropping GDP forecasts again; something we’ve been ahead of all of them in foreseeing).

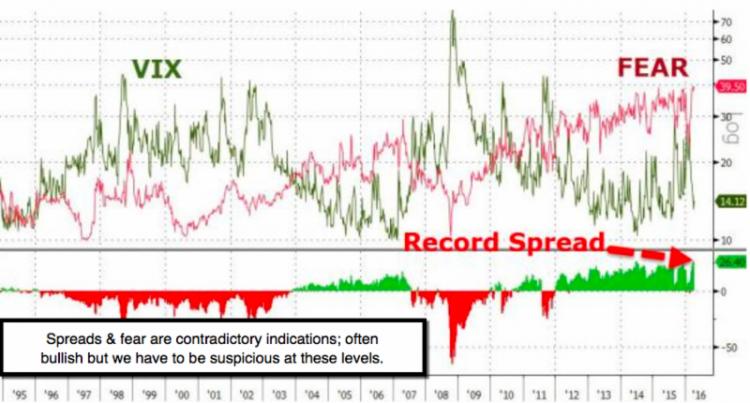

The market remains extended; financial re-engineering won’t help the near-term; the ‘process’ of convincing traders that we’ve had the swan-song of the rebound continues; and an April-May period of greater overall risk has been entered. The idea is the first decline becomes a warning shot; one or more rebounds as they really will fight back to deny correction; then a real McCoy decline ensues.