Most global indexes had a bad day today. Among the biggest losers were the Nikkei, ended its session at -2.42%, and Germany’s DAX fared even worse at -2.63%. At its open, our benchmark S&P 500 appeared to follow the trend, plunging a 1.03% in the opening minutes. It then oscillated in a narrow range before hitting its -1.14% intraday low near the close before trimming the loss to -1.01% for the session. The index had briefly dipped back into the red year-to-date, but the buying near the end lifted it to a microscopic 0.06% gain for 2016. Today’s loss was the largest decline in 19 sessions since its 1.12% loss on March 8th.

If today’s market behavior is worrisome, then a CNBC Pro Subscription will give you the details of Thomas Lee’s reassuring note to his clients (he’s Head of Research at Fundstrat Global Advisors). Lee’s company believes, accoriding to CNBC, that “equity markets are poised to make new highs in coming months.”

The yield on the 10-year note closed at 1.73%, down five basis points from the previous close.

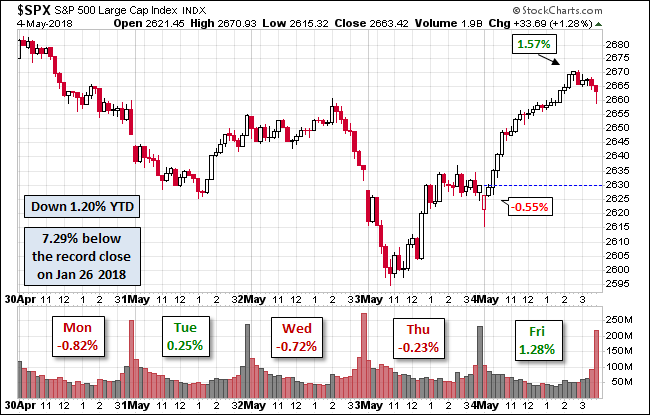

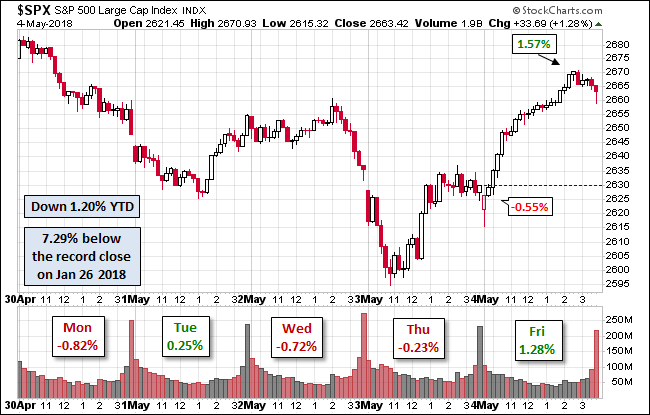

Here is a snapshot of past five sessions in the S&P 500.

Here is a weekly chart of the S&P 500, which shows the behavior of the index since well before its record high in May of last year. The pattern of lower highs and lower lows since the May 2015 peak will need to be broken if Thomas Lee’s optimistic view referenced above has any substance.

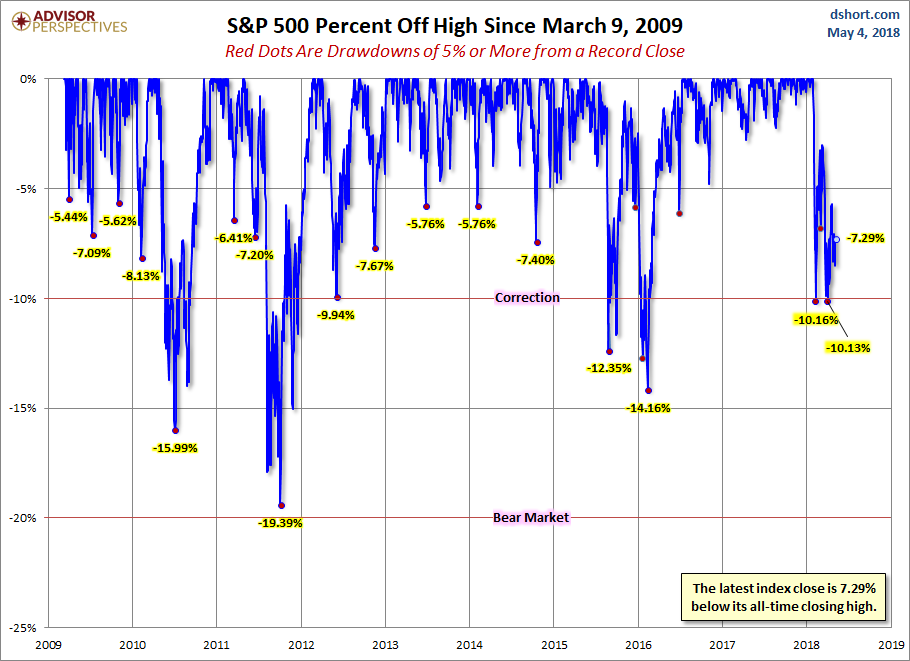

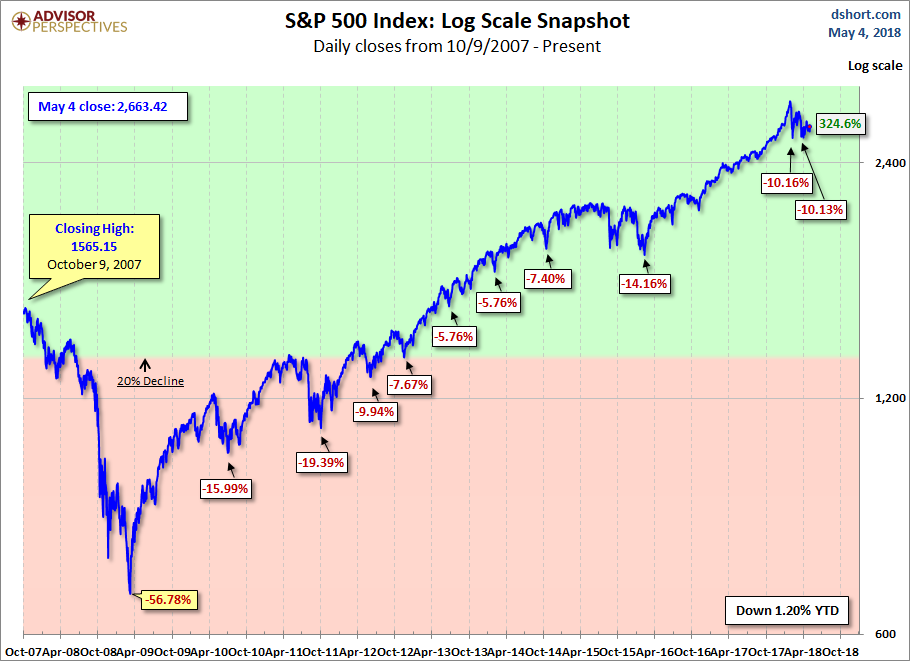

A Perspective on Drawdowns

Here’s a snapshot of selloffs since the 2009 trough.

Here is a more conventional log-scale chart with drawdowns highlighted.

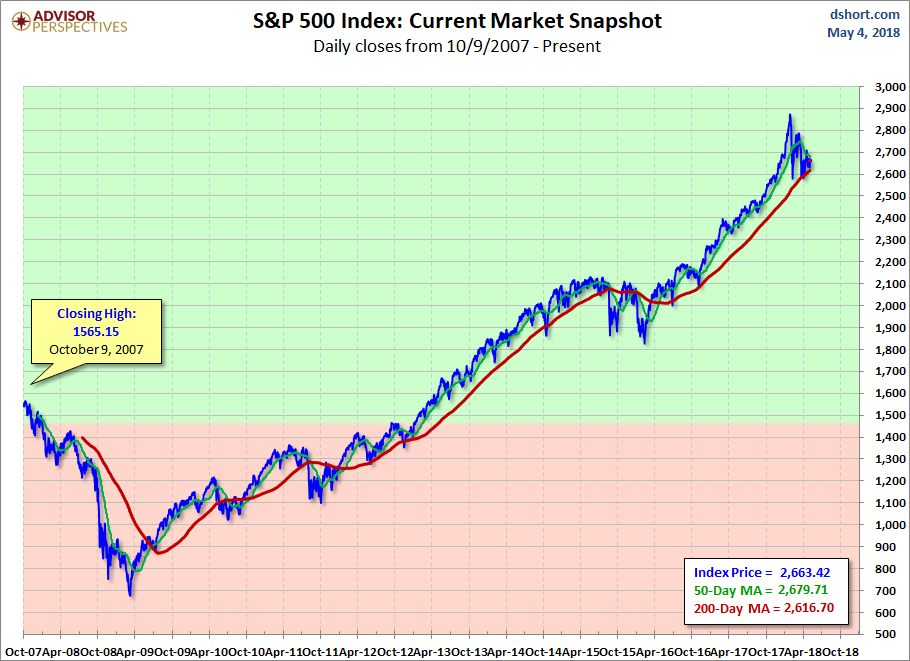

Here is a linear scale version of the same chart with the 50- and 200-day moving averages.

A Perspective on Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We’ve also included a 20-day moving average to help identify trends in volatility.