Unlike yesterday’s overnight session, which saw some substantial carry FX volatility and tumbling European yields in the aftermath of the TSY’s anti-inversion decree, leading to a return of fears that the next leg down in markets is upon us, the overnight session has been far calmer, assisted in no small part by the latest China Caixin Services PMI, which rose from 51.2 to 52.2 (even if the employment index dropped to a three year low, suggesting China’s labor problems are only just starting).

Adding to the overnight rebound was crude, which saw a big bounce following yesterday’s API inventory data, according to which crude had its biggest inventory draw in 2016, resulting in WTI rising as high as $37.15 overnight. The oil market is now looking at today’s more definitive EIA report, which is also expected to show an inventory build. “The API surprised the market at a time when it was looking to move higher after several days of losses; the API provided this trigger,” says Saxo Bank head of commodity strategy Ole Hansen. “Kuwait saying a deal is still a possibility at the Doha meeting has also helped.”

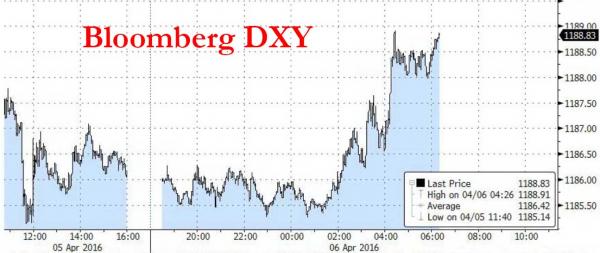

Curiously, the rebound in oil took place even as the BBG Dollar index saw a sharp increase overnight.

But while the dollar rose, the Yen failed to drop, and as a result, the USDJPY has remained just barely above 110, leading to another session in the red for Japan’s Nikkei: surely by now Abe and Kuroda must be asking themselves if complying with the Shanghai Accord was really worth it. A few more percent drop, which wipes out a few dozen trillion in local pensions, and the Japanese people may ask themselves too.

“It is still difficult to buy stocks because of the yen. There are hardly any positive factors for stocks,” Chihiro Ohta, general manager of investment information at SMBC Nikko, told Bloomberg. “Investors are concerned about the global economy again and are turning to risk-off as the IMF may downgrade its growth forecasts.”

Meanwhile in China, good news was bad, as the better than expected Services PMI led to a 0.1% drop in the Composite after the benchmark index hit a three-month high on Tuesday. Data released on Wednesday by Caixin Media and Markit Economics showed their services purchasing managers’ index increased to 52.2 in March. An official factory gauge last week showed improving conditions for the first time in eight months, while industrial profits halted a seven-month losing streak.

E-mini futures on the S&P 500 Index rose 0.3 percent. The underlying U.S. equity benchmark index slipped 1 percent on Tuesday. The rally that lifted the S&P 500 as much as 13 percent from a 22-month low in February has started to lose momentum, with sentiment shifting as investors assess whether central banks can fend off weakness in the global economy. The U.S. central bank releases the minutes from its latest meeting on Wednesday.

E-mini futures on the S&P 500 Index rose 0.3 percent. The underlying U.S. equity benchmark index slipped 1 percent on Tuesday. The rally that lifted the S&P 500 as much as 13 percent from a 22-month low in February has started to lose momentum, with sentiment shifting as investors assess whether central banks can fend off weakness in the global economy. The U.S. central bank releases the minutes from its latest meeting on Wednesday.

This is where all key markets stood as of this moment.

Top Global News

Bill Ackman’s Pershing Square holds 1Q investor call; follow TOPLive for our blog coverage starting 10am