While breadth and seasonals are constructive, BofA’s Stephen Suttmeier warns complacent put/call, VXV/VIX, and volume distribution are April risk factors.

Since mid-March, accumulation (up volume or buying) has fallen relative to distribution (down volume or selling) as the US equity market has rallied, which is negative divergence and risk factor for April. To suggest that this complacency is beginning to take its toll on price action, the S&P 500 must break nearby support at 2044-2022, which coincides with revised channel support from February, and fall out of its daily overbought condition.

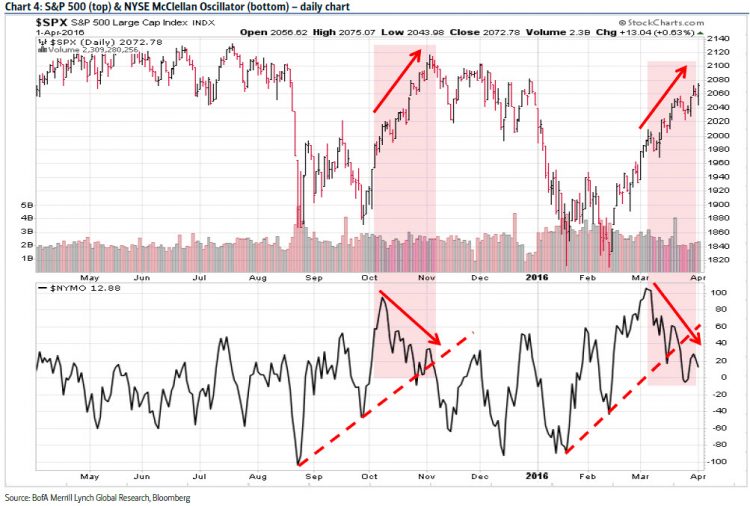

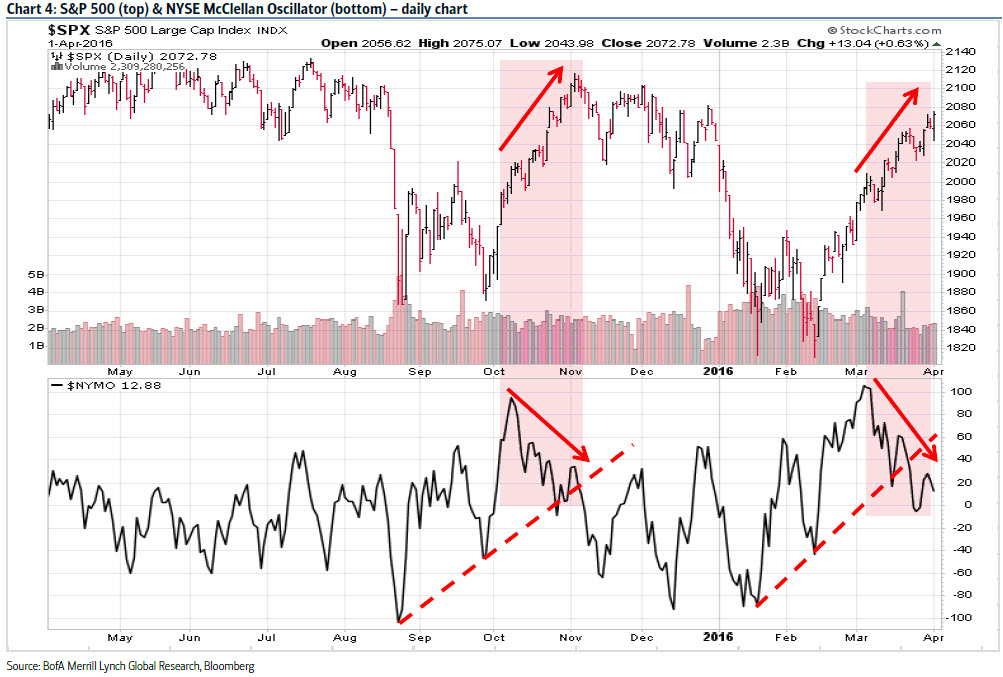

The NYSE McClellan Oscillator remains weak and has a month-long bearish divergence with the S&P 500 moving into early April. This is similar to the divergence moving into early November, and a risk factor for April.

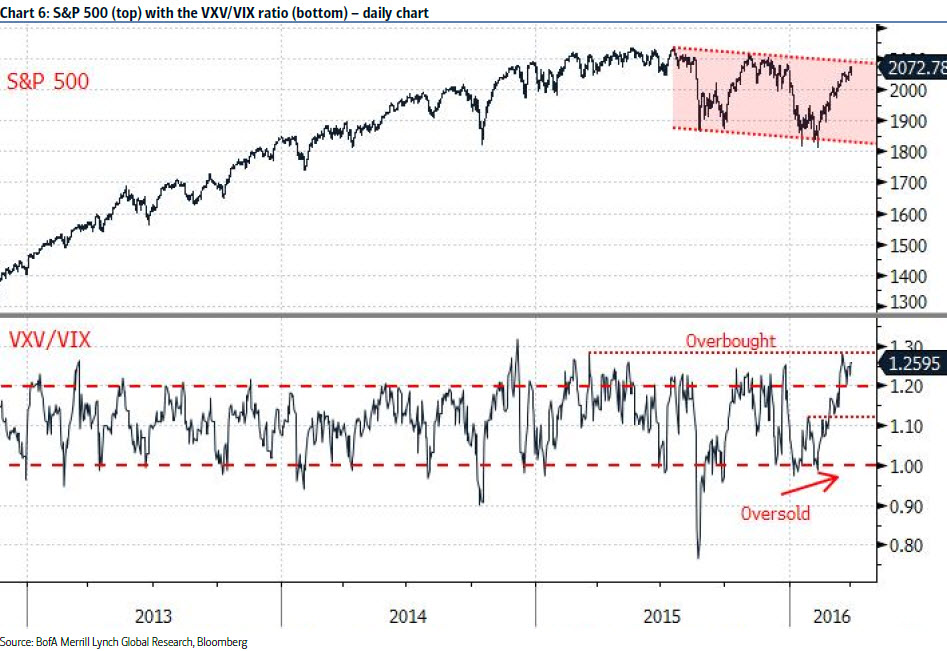

VXV/VIX says investors very complacent about volatility

There is nothing like a 14%+ rally in 34 days, with help from a Dovish Janet Yellen last week, to make investors feel more comfortable about the US equity market. In terms of sentiment, the VXV/VIX ratio is extremely overbought or complacent as investors do not expect an immediate increase in volatility. The VXV/VIX remains in the overbought zone above 1.20 after hitting the highest reading since March 2015. The S&P 500 has generally struggled on these extreme contrarian bearish readings in the VXV/VIX, which is a risk factor as we move into April.

25-day put/call as complacent as early-Nov & late-May 2015

The CBOE 25-day total put/call ratio has dropped back to the lowest or most complacent levels seen since the S&P 500 highs in early-November at 2116 and late-May 2015 at 2135. This is contrarian bearish, with the 25-day put/call at 0.94 vs. 0.94 in early November and 0.92 in late May. This low put/call ratio is an April risk factor.

VIM Distribution is complacent with a bearish divergence