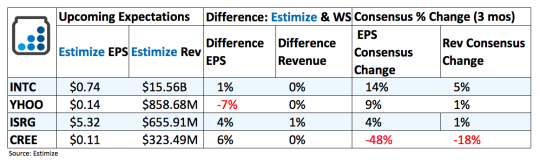

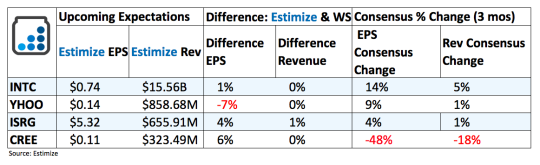

Intel (INTC): Intel, like many of its peers, has shifted its focus away from its waning legacy business toward high growth markets such as AI, IoT Data Centers and Security. Last quarter the company saw these segments jump on a year over year basis with expectations to do the same on Tuesday. Client Computing was one of the lone sore spots in the second quarter report, declining 3% on a sequential and year over basis. While it’s safe to remain cautious about the PC market, management expects PC related sales to show some improvement this quarter.

Intel faces a number of imminent threats that could put pressure on earnings for multiple quarters. Google, IBM (IBM) and seven others have joined hands to take on Intel’s Data Center Group. The consortium includes many large well known companies and some smaller ones. Its impact on Intel remains to be seen but management would be wise to not take it lightly. Meanwhile, Apple (AAPL) is rumored to be replacing Intel chips in all of its Macbooks. This would be a near term blow but not one that would significantly cripple the company.

Currency headwinds and economic uncertainty in Europe are among the broader concerns facing the tech space, Intel included. Intel has a large presence worldwide which means they are susceptible to compressed earnings from the strong dollar. It appears as though more factors are working against Intel then for them, despite increasing optimism heading into its report.

Yahoo (YHOO): Yahoo’s earnings woes have been well documented over the years. User engagement and ad revenue have continually declined as consumers shift their focus to more mainstream platforms particularly Facebook (FB) and Google (GOOGL). This has resulted in declines across the board most notably in core search and display revenue. Last quarter posted a 13% decline in search revenue and 21% in display compared to the second quarter of 2015. It won’t be shocking if this continues to drop given the massive breach on the platform.