After failing to break below, once again AUD/USD above Ichimoku cloud is making its way up. Temporary correction? Or is the upternd here to stay?

AUD/USD Above Ichimoku Cloud | Technical Analysis

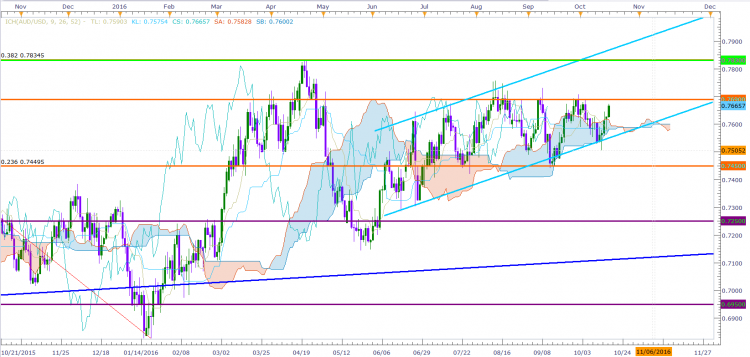

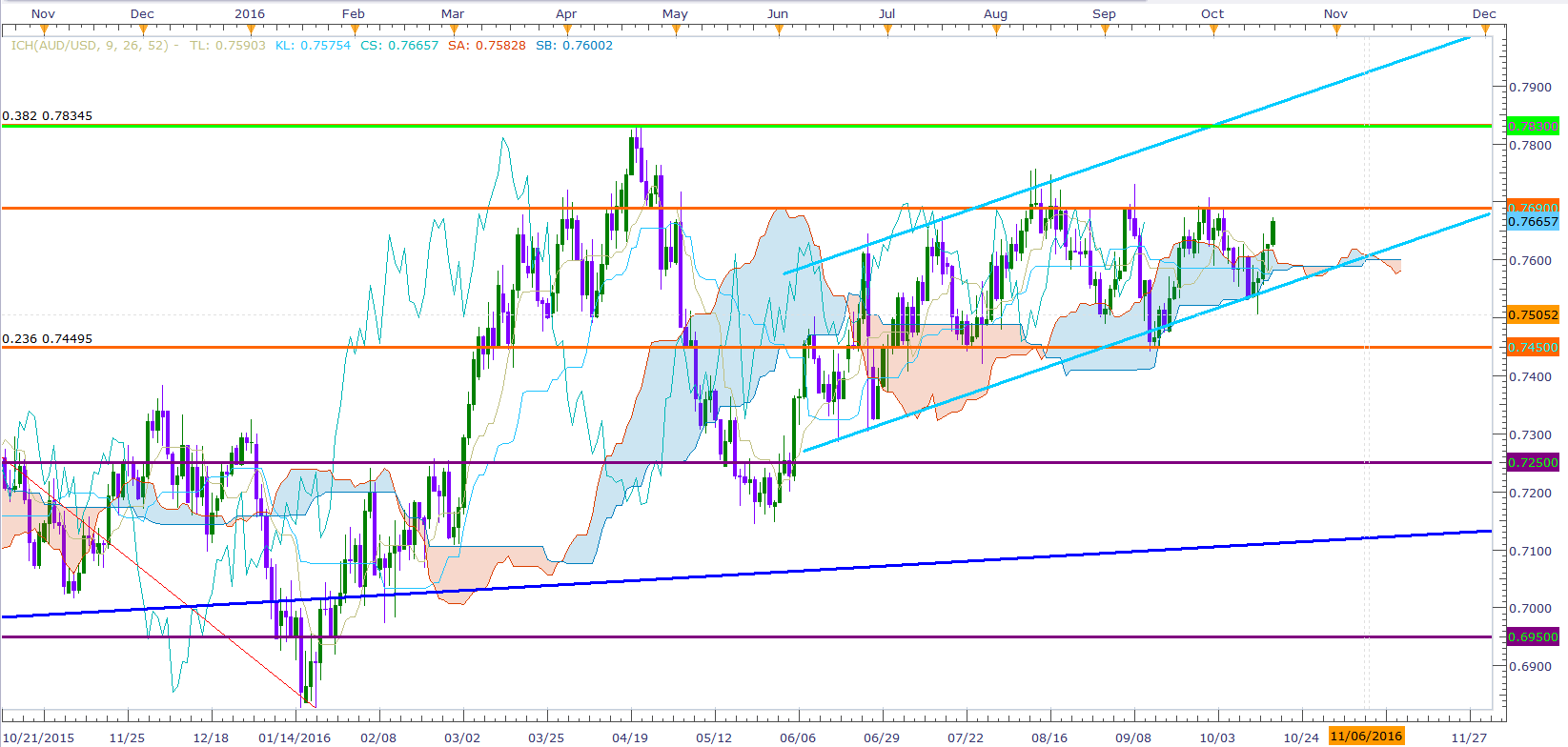

Back within an upward channel, the AUD/USD confirms above Ichimoku cloud once again, after failing to break below it. However, this will be the third time the pair has attempted a break above a new pivot level of 0.7690. The daily range of the pair seems to be shrinking within a triangle chart pattern. And while this break above the Ichimoku cloud was conducted by a bullish engulfing, we still need a break above 0.7690 to confirm our bullish position on the pair.

A break above this pivot could signal further up-moves towards medium-term pivot level of 0.78.

However as I mentioned in my previous AUD/USD report, with the Ichimoku cloud flattening, this upward cycle could be short-lived and the pair could continue ranging up-and-down within the upper and lower bands of the channel.

AUDUSD Above Ichimoku Cloud | Technical Analysis

Supports are set at 0.7250 and 0.6950 in extension, while long-term resistance levels are set at 0.7830, 0.8150 and 0.8450 respectively.

Fundamentals

AUD: Early during Tuesday’s Sydney session, Philip Lowe, governor of the Reserve Bank of Australia (RBA), said that while recent factors that have led to weak inflationary pressures “will continue for a while yet”, he acknowledged that “this does not mean that we have drifted into a world of permanently lower inflation in Australia”.

Providing confidence he noted that “domestic demand is expected to strengthen gradually” as the drag on Aussie economy from the decline in mining investment comes to an end.

From his speech, many analysts concluded that he may not be in a rush to cut interest rates, which in turn led to AUD gains.

USD: The US printed worse-than-expected Industrial production on Monday which temporarily got in the way of rapid US dollar strength. As a result, dollar-crosses such as EUR/USD and NZD/USD saw a correction, while AUD/USD saw a rapid bullish sentiment.