Saudi Arabia has officially launched its much anticipated, first international bond sale on Wednesday, as the kingdom turns to debt markets to help ease a fiscal squeeze from the two-year slump in oil prices, which has slammed not only the country’s economy, leading to a period of unprecedented austerity resulting in widespread job cuts and a slowdown in local construction and infrastructure projects, but also has impacted the country’s bank sector where the largest bank has seen its shares plunge to all time lows, as bets on a currency devaluation continue to rise.

As Bloomberg reported moments ago, the sale has officially started, with Saudi Arabia seeking to sell between $10 and $15 billion in three tranches, a 5Y, 10Y and 30Y offering. Pricing is expected to take place tomorrow, Oct. 19; with the books set to close at 5pm in NYT on Tuesday October 15. Tentative pricing will be as follows:

Issuer: Kingdom of Saudi Arabia acting through the Ministry of Finance

According to the FT, Riyadh is thought to be targeting a sale between $10bn and $15bn, making it the largest issue of international debt in the Middle East and a potential rival to Argentina’s record-breaking $16.5bn emerging market bond sale earlier this year.

Bankers said strong demand is expected for the debut bond, which comes amid heavy buying of other emerging market debt, including Mexico, Qatar and Argentina. “All going well they should print later in the week,” said one banker.

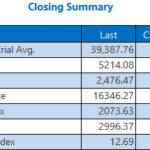

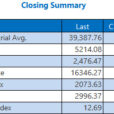

Investors who have met Saudi delegates say they expect the bonds — likely to be split into five, 10 and 30-year maturities — to be issued with a yield anywhere between 160 and 200 basis points over equivalent US government benchmarks.

The kingdom’s first international bond is part of a radical plan to wean the economy off its reliance on oil and was first announced in November 2015, as oil prices fell to $50 a barrel from $115 a barrel the previous year.