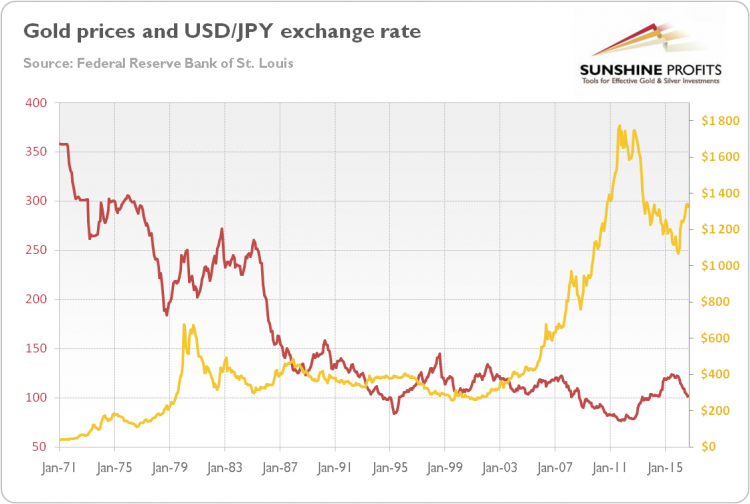

More and more analysts are pointing out the tight correlation between the Japanese yen and the price of gold. Let’s thus investigate the link between these two assets. The chart below shows the long-term relationship between the yellow metal and the USD/JPY exchange rate. At first glance, there is no strong, clear pattern. Surely, gold prices rose in the 1970s and the 2000s, when the U.S. dollar weakened against the yen. But the Japanese currency also strengthened from the mid-1980 to mid-1990, when gold remained in a bear market.

Chart 1: The USD/JPY exchange rate (red line, left axis) and the price of gold (yellow line, right axis, London P.M. Fix) from January 1971 to September 2016.

However, the relationship between these two assets became much more interesting in recent years. Let’s look at the next chart, which plots the price of gold and the USD/JPY exchange rate since 2012.

Chart 2: The USD/JPY exchange rate (red line, left axis) and the price of gold (yellow line, right axis, London P.M. Fix) from January 2012 to September 2016.

As you can see, there is almost perfect negative correlation between the USD/JPY exchange rate and gold. Indeed, in the whole range of data since 1971, the correlation coefficient is -0.57, which is definitely not bad, but far from a totally negative link. However, for the period of 2012-2016 the correlation coefficient stands at -0.94, which signals a very strong negative relationship. Why did the correlation become so tight? Well, in a sense it is very simple: when the yen weakens, the U.S. dollar strengthens. Investors should remember that the USD/JPY is one of the world’s major currency pairs, just like the EUR/USD. And because gold trades like a bet against the greenback, a strong U.S. dollar implies weak gold prices.

However, this answer does not solve the whole riddle, as gold now has a stronger relationship with the yen than with any other currency, e.g., the negative correlation between gold and the broad U.S. dollar index in 2012-2016 amounts to only -0.7. It probably results from the yen carry trade(borrowing yen at a low-interest rate and investing it in higher-yielding assets abroad), which makes the Japanese currency behave like a safe haven, despite the country’s economic problems (like sluggish growth and high public debt). This is because carry trade usually intensifies when the risk appetite rises and weaken during periods of falling confidence (however, another reason may be Japan’s current account surpluses).