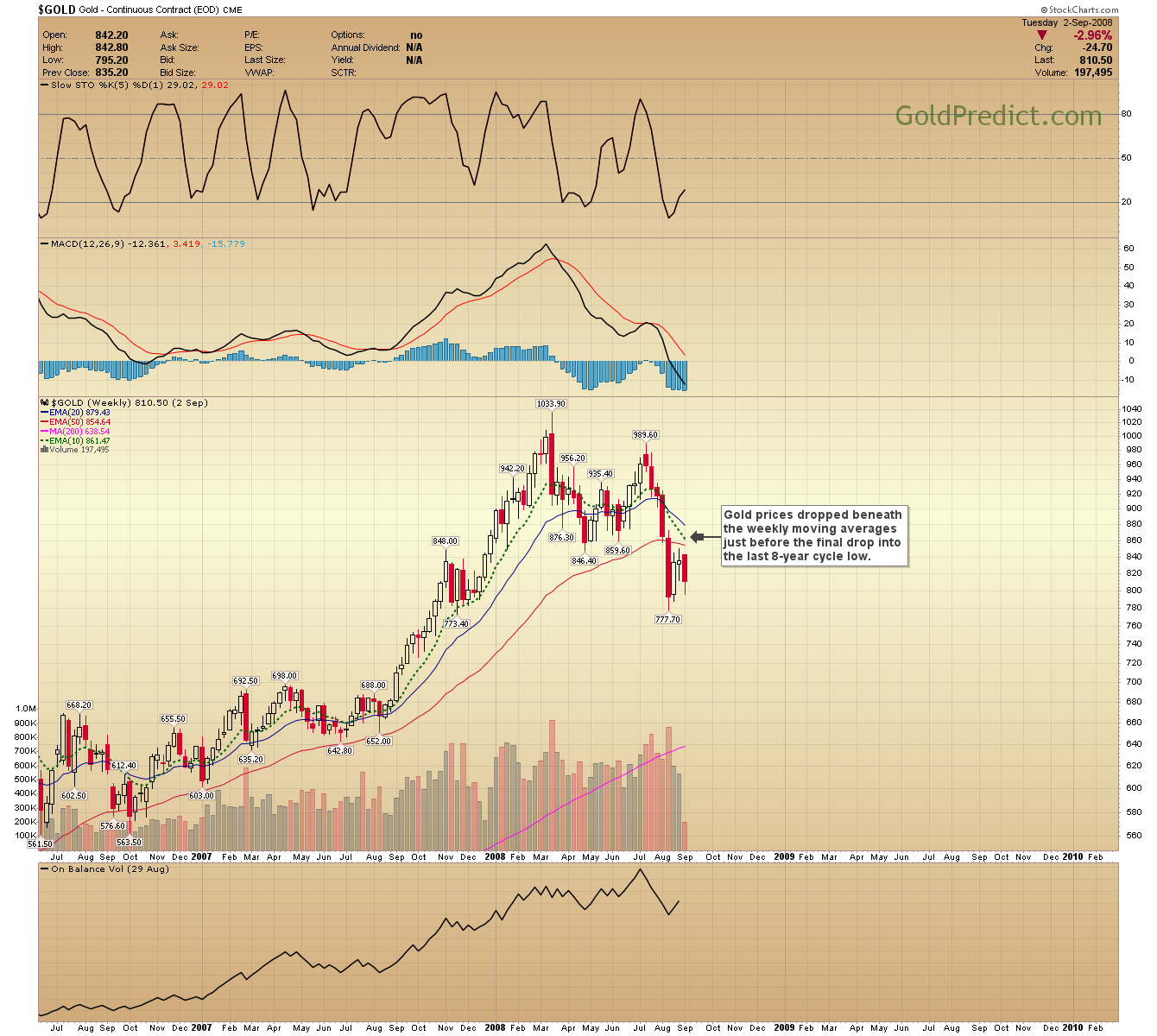

Here is why I’m tentative on holding significant positions in gold, silver, and miners right now. Prices have fallen below all of the key weekly moving averages, and we are still within the timing window for an 8-year cycle drop. The 8-year cycle forces will abate after February of next year. Until then, we need to proceed cautiously.

-GOLD NOW- Gold prices have dropped below all weekly moving averages. Prices could still collapse into an 8-year cycle low by February. I won’t feel comfortable allocating more of my account until gold trades above $1,310. Note: All precious metal assets we cover are convincingly beneath these key weekly moving averages.

-GOLD 2008- Gold prices dropped beneath the weekly moving averages just before the final drop into the last 8-year cycle low. We are in a similar setup now.

I feel like this is the last opportunity for gold, silver, and miners to stave off the bearish 8-year cycle forces. If prices break the recent lows (Gold $1,201.30 – Silver $16.43 – GDX $20.13 – GDXJ $23.80) the 8-year cycle could pull them substantially lower, possibly to new lows.